| Statistics | |

| Population | 204m1 |

| Internet penetration | 58% |

South America’s biggest media market has long been dominated by popular free-to-air TV stations which attract more than 50% of advertising spend. But this supremacy is being challenged in urban areas of the country, where online media has consolidated its position as the main source of news.

Top Brands % Weekly Usage (TV, Radio and Print)

TV, Radio and Print

| Weekly use | Main source | |

|---|---|---|

| Globo News | 53% | 21% |

| Jornal do SBT | 39% | 11% |

| Record News | 33% | 8% |

| O Globo | 32% | 11% |

| BandNews | 31% | 7% |

| Folha de S. Paulo | 22% | 5% |

| Regional or local newspaper | 18% | 6% |

| O Estado de S. Paulo | 17% | 3% |

| Commercial radio news | 17% | 4% |

| CNN | 16% | 2% |

| Rede TV News | 13% | 1% |

| BBC News | 11% | 1% |

| A free city newspaper | 10% | 1% |

| Jornal Extra | 8% | 1% |

| Jornal O Dia | 8% | 0% |

| Jornal Zero Hora | 7% | 2% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| Globo News Online (inc. G1) | 51% | 13% |

| UOL online | 49% | 16% |

| O Globo online | 40% | 11% |

| Yahoo News | 32% | 6% |

| Record News Online (inc. R7.com) | 31% | 5% |

| Folha de S. Paulo online | 29% | 5% |

| Terra | 27% | 3% |

| MSN News | 27% | 7% |

| BandNews online | 27% | 2% |

| Jornal do SBT online | 26% | 3% |

| Regional or local paper website | 20% | 4% |

| O Estado de S. Paulo online | 20% | 1% |

| CNN online | 16% | 1% |

| iG. Online | 14% | 2% |

| Rede TV News online | 13% | 1% |

| BBC News online | 13% | 1% |

Overview of key developments

By Rodrigo Carro

Reuters Institute Journalist Fellow and financial journalist

Monthly audiences for some of the top news brands online – such as G1 and UOL – were over 30 million unique visitors in 2015. However, in terms of popularity news sites in Brazil are no match for Facebook. Since 2011, when the company opened an office in the country, the number of Brazilians using Facebook has increased nearly six-fold to more than 83 million. 2 Second only to Facebook among the top social media brands used for news, is WhatsApp, which is estimated to have 100m users, meaning that one in every two Brazilians has the app.

The fascination exerted by social media is often explained in terms of Brazil’s hyper-social culture, where people are considered to be more open to making friends. But Facebook and other networks are being used for more than just keeping in touch. In urban Brazil, social media are used as a source of news by approximately 72% of respondents in our survey. In December 2015, a dozen Brazilian news brands – some of them owned by mainstream media heavyweights – started to publish directly to Facebook using the Instant Articles format.

The search for new sources of revenue is critical for the print media, which was hit hard by last year’s contraction of the Brazilian economy, the worst downturn in 25 years. More than 1,400 media professionals lost their jobs in 2015. Examples of the current downsizing include the magazine giant Abril, which ceased publishing three titles and sold seven other news brands in 2015, and the financial newspaper Brasil Econômico, owned by Portuguese group Ongoing, which closed last year.

Despite the key role that the press has played in uncovering recent political scandals, nine out of the ten best-selling newspapers in the country lost readers in 2015. 3 By contrast, online news usage rose 50% in the first half of 2015 when compared to the same period of the previous year. 4 The increase in digital circulation has happened despite the adoption of paywalls by a number of Brazilian papers. By the end of 2014, ten major dailies had implemented paywalls, according to the National Association of Newspapers (ANJ).

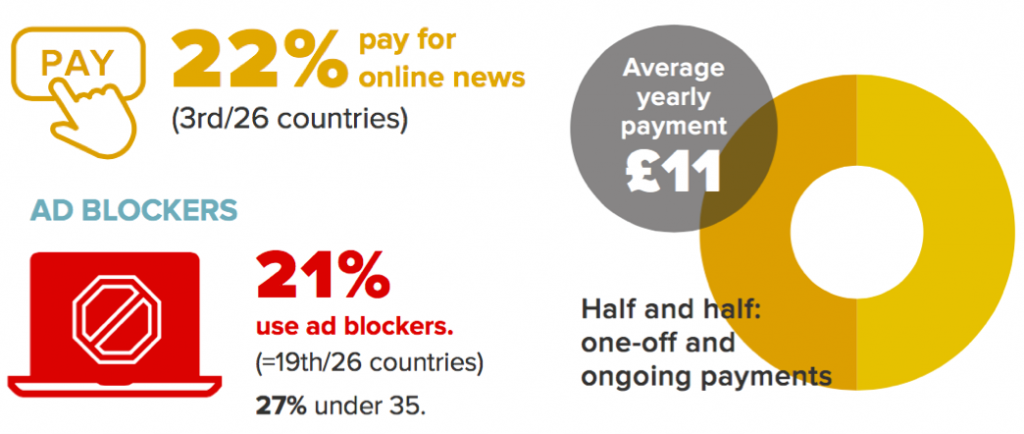

Around one in five (22%) urban Brazilians say they paid for some kind of online news content during the past year. That’s the third highest rate among the 26 countries analysed, with demand highest for premium content such as financial news and on-demand video. Publishers have also been experimenting with branded and sponsored content in print versions of the major Brazilian newspapers but also on online portals. Folha de S. Paulo, the daily with the highest circulation in the country, launched a business unit specialising in producing this kind of content in different formats, including digital and video, following in the footsteps of other major media groups.

In Brazil, ad-blockers are not yet a major source of concern for online advertisers, as penetration remains relatively low at 21%.

Changes in media usage 2013–2016

TV news remains the most important source of news overall in Brazil, though online is ahead with our urban sample. Social media has grown rapidly with over 70% using it as a source of news each week.

WEEKLY REACH PER DEVICE

| Computer | Smartphone | Tablet | |

|---|---|---|---|

| 2013 | 83% | 23% | 14% |

| 2014 | 64% | 35% | 20% |

| 2015 | 71% | 50% | 19% |

| 2016 | 68% | 63% | 19% |

SOURCE OF NEWS 2013–16

| TV | Online (inc. social) | Social | ||

|---|---|---|---|---|

| 2013 | 75% | 50% | 90% | 47% |

| 2014 | 78% | 47% | 90% | 56% |

| 2015 | 81% | 44% | 91% | 64% |

| 2016 | 79% | 40% | 91% | 72% |

Paying for news

Although almost a quarter of our urban sample says they pay for online news, a significant proportion is for one-off purchases. The average yearly payment is one of the lowest in our survey.

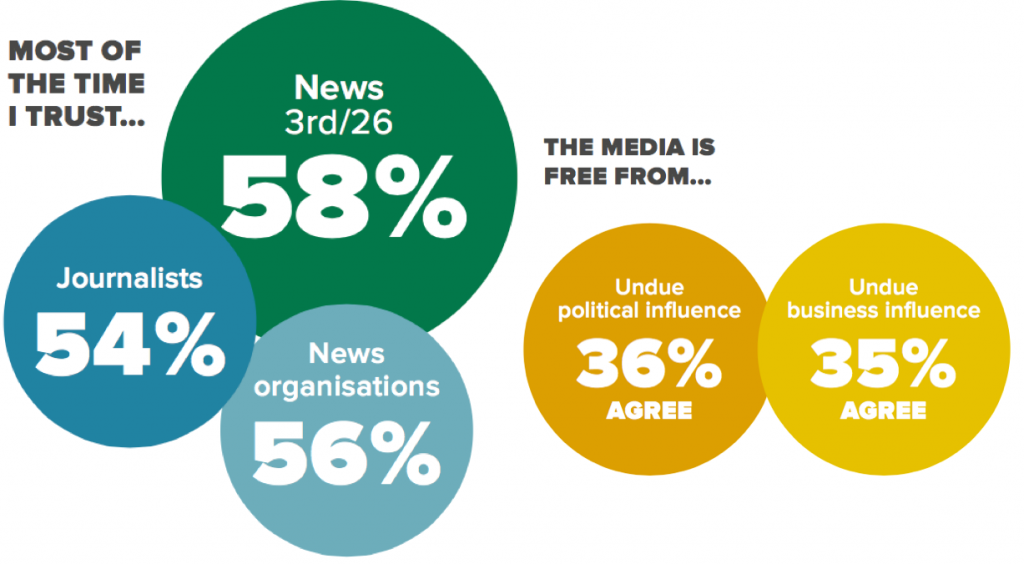

Trust

In a year in which corruption scandals and weak economic figures filled the headlines, trust in news remained high. Polarisation between supporters and opponents of the current government helps to explain why a little more than one-third of the urban population considers journalists to be free from undue political influence.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 69% | 70% | |

| 2 | 39% | 37% | |

| 3 | YouTube | 37% | 38% |

| 4 | 13% | 15% | |

| 5 | 11% | 14% |

- Data are from urban Brazil, rather than a fully nationally representative sample. This will tend to represent richer and more connected users. ↩

- May 2014, according to the then chief executive of Facebook in Brazil, Leonardo Tristão. ↩

- Instituto Verificador de Comunicação (IVC). ↩

- National Association of Newspapers (Associação Nacional de Jornais). ↩