| Statistics | |

| Population | 10.5m |

| Internet penetration | 80% |

The Czech media landscape is characterised by the dominance of commercial television, which attracts about half of the total advertising spend, and by a highly concentrated newspaper sector, mostly in the hands of local business tycoons.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| Ceska televize news (inc. 1, 2, CT24) | 67% | 44% |

| TV Nova news | 30% | 9% |

| Prima news | 27% | 7% |

| Mlada Fronta DNES | 20% | 4% |

| Cesky rozhlas Radiozurnal news | 16% | 4% |

| Blesk | 15% | 2% |

| Radio Impuls news | 14% | 2% |

| Metro | 13% | 2% |

| A regional or local newspaper | 12% | 1% |

| TV Barrandov news | 12% | 1% |

| Frekvence 1 news | 10% | 2% |

| Denik | 9% | 1% |

| Evropa 2 news | 8% | 2% |

| Cesky rozhlas Dvojka news | 6% | 1% |

| Pravo | 6% | 1% |

| Lidove noviny | 6% | 1% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| Mlada Fronta DNES online (iDnes.cz) | 55% | 26% |

| Pravo online (novinky.cz) | 47% | 21% |

| Aktualne.cz | 43% | 10% |

| Ceska televize news online | 30% | 8% |

| TV Nova news online | 26% | 5% |

| Prima televize news online | 23% | 3% |

| Super.cz | 20% | 2% |

| Blesk online | 18% | 1% |

| Denik online | 18% | 1% |

| Parlamentnilisty.cz | 14% | 2% |

| Hospodářské Noviny online | 14% | 1% |

| Lidove noviny online | 14% | 1% |

| Tyden.cz | 10% | 0% |

| Rozhlas.cz | 8% | 1% |

| Extra.cz | 8% | 0% |

| Reflex.cz | 7% | 0% |

Overview of key developments

By Václav Štětka

Institute of Sociological Studies, Charles University, Prague

The Czech advertising market has continued to trend upwards – by 8% in 2015. 1

The circulation of Czech newspapers decreased further last year, with most titles having declined by 5–10%, 2 Seznam.cz.] the public service broadcaster Česká televize continues to hold its steady market position, with its flagship channel ČT1 being the second most watched station with a 15% audience share. In combination, the audience for all its channels are roughly equal to that of the stations controlled by the largest commercial broadcaster Nova Group (30.4% vs 30.70%).

Czech search engine Seznam has been gradually losing ground to Google (35% vs 45% of the market share by the end of 2015), but continues to hold the position of the third most visited website in the country behind Facebook.com and Google.cz. [67. https://www.markomu.cz/nejnavstevovanejsi-weby/ This illustrates the continuing attractiveness of the localised online services, which are still important for Czech internet users even in today’s globalised digital environment.

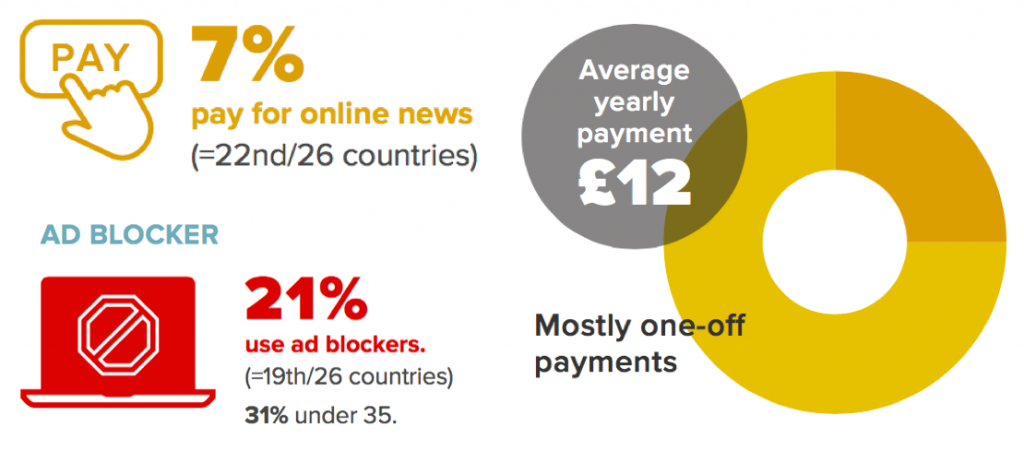

Paying for news

The process of moving towards paid content has been rather slow, as Czech news consumers have consistently shown a lack of willingness to pay for information online.

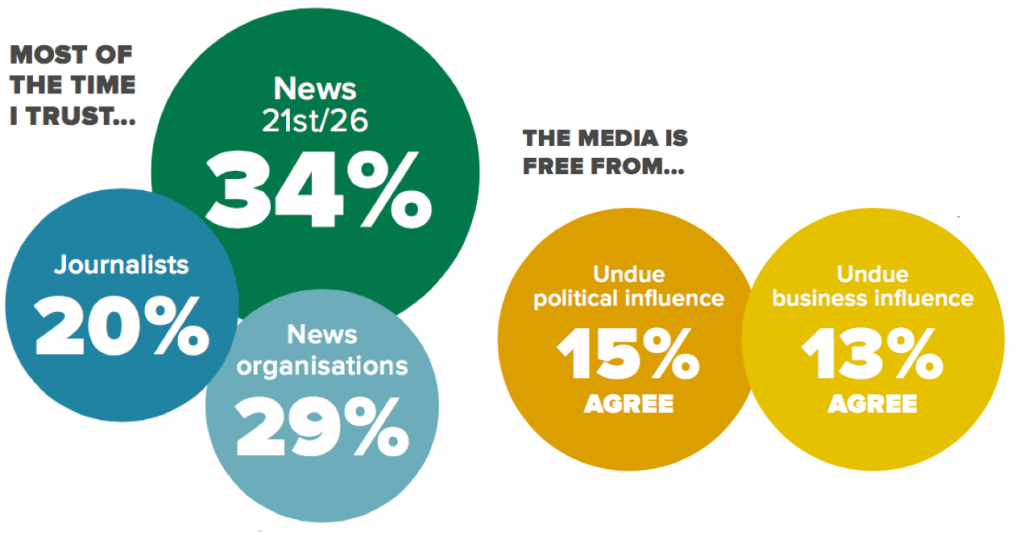

Trust

Low trust in news, news organisations and journalists can be partially explained by the recent ownership changes affecting much of the Czech print media sector. Local billionaires now have considerable influence, including those pursuing political careers, such as Deputy Prime Minister Andrej Babiš, who has owned two quality papers and the biggest commercial radio station since 2013.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 46% | 51% | |

| 2 | YouTube | 22% | 21% |

| 3 | Google+ | 5% | 3% |

| 4 | 3% | 3% | |

| 5 | 3% | 4% |

- https://www.nielsen-admosphere.cz/press/tz-trh-s-reklamou-v-roce-2015-vzrostl-o-temer-8/ This was mainly due to rising spending on TV (+14%), while print media and outdoor advertising stagnated. Online ad spending has grown to almost a 20% share of the advertising market – around the same as print. [63. http://www.inzertnivykony.cz ↩

- http://web.archive.org/web/20161111065123/http://www.abccr.cz/overovana-data/periodicky-tisk/ a trend observed across both quality papers and the tabloid press. Some positive news came with the launch of a new weekly news magazine – a local version of Newsweek, licenced by its US publisher IBT Media.

The transformation of print media ownership from long-established Western owners to local proprietors continued in 2015. Regional publisher, Vltava-Labe-Press, owner of over 70 local versions of the daily Deník, was sold by Verlagsgruppe Passau to the Czech-Slovak investment group Penta – already a significant player on the Slovak print media market. On the other hand, the media market experienced the first significant inflow of capital from Asia, with the Chinese investment company CEFC having acquired a minority share (49%) in the media house Empresa Media, owner of the fourth biggest television broadcaster TV Barrandov and publisher of several news weeklies.

The Czech news media has been trying to deal with declining revenues by inventing new strategies to attract audiences and subscribers online. Economia, which was the first major Czech publisher to try a metered paywall, shifted to a hard paywall for selected content in 2016 following disappointing results. Digital-only subscribers still account for less than 10% of all subscribers of the publisher’s flagship, the financial daily Hospodářské noviny.

A hard paywall was also announced by the publisher of the biggest-selling Czech tabloid Blesk, the Czech News Centre, which has already started to charge for viewing football matches on its online sports portal iSport.cz. Another leading publisher MAFRA has tried a different approach – launching web e-readers for the two quality newspapers, Mladá fronta DNES and Lidové noviny. The company reported a doubling of digital subscribers, [65. https://www.mediaguru.cz/clanky/2015/03/mafra-ctecka-zdvojnasobila-prijmy-z-obsahu/#.VwThGHohEhQ%5D albeit from a very low base given that most of their content remains free of charge.

In an attempt to reach new audiences and take advantage of the new digital multi-channel environment, some news outlets have been introducing audio podcast versions of their news articles or reports. These include weekly publications Respekt and Forbes, along with the daily Hospodářské noviny and the increasingly popular internet TV channel DVTV. This innovative start-up, launched in 2014, presents itself as a web-based public service TV and raised over 2 million CZK (about £60,000) from the public in a successful crowdfunding campaign.

Despite the pressures from both traditional commercial competitors and new digital-born projects, [66. Including the TV channel Stream.cz, run by the largest Czech search engine [or internet portal ↩