| Statistics | |

| Population | 8m |

| Internet penetration | 87% |

The media environment is characterised by multiple languages, a strong public broadcaster (SRG SSR), concentrated media ownership, and a number of widely read free newspapers.

Top Brands % Weekly Usage (TV, Radio and Print: German Speaking)

| Weekly use | Main source | |

|---|---|---|

| SRF News (incl. Tagesschau, radio, etc.) | 70% | 36% |

| 20 Minuten | 50% | 14% |

| Blick (inc. evening and Sunday editions) | 38% | 7% |

| German commercial TV news (e.g. RTL) | 28% | 5% |

| German public TV news (e.g. ARD) | 26% | 3% |

| Other commercial news (e.g. Tele Züri) | 23% | 3% |

| A regional or local newspaper | 19% | 4% |

| Tages Anzeiger | 15% | 4% |

Top Brands % Weekly Usage (Online: German Speaking)

| Weekly use | Main source | |

|---|---|---|

| 20 Minuten online | 59% | 31% |

| Blick and Blick am Abend online | 35% | 10% |

| SRF News Online | 31% | 5% |

| Bluewin news | 25% | 9% |

| Tages Anzeiger online | 18% | 6% |

| Teletext.ch | 16% | 2% |

| Websites of a regional or local newspaper | 14% | 3% |

| NZZ online | 12% | 2% |

Top Brands % Weekly Usage (TV, Radio and Print: French Speaking)

| Weekly use | Main source | |

|---|---|---|

| RTS News (e.g. Le Journa, radio, etc.) | 75% | 34% |

| 20 Minutes | 55% | 17% |

| Le Matin (inc. Sunday edition) | 46% | 6% |

| French commercial TV news (e.g. TF1) | 38% | 8% |

| French public TV news | 36% | 5% |

| 24 heures | 24% | 5% |

| Commercial radio news | 19% | 3% |

| A regional or local newspaper | 17% | 4% |

Top Brands % Weekly Usage (Online: French Speaking)

| Weekly use | Main source | |

|---|---|---|

| 20 Minutes online | 59% | 32% |

| Le Matin online | 35% | 8% |

| RTS News online | 34% | 6% |

| 24 heures online | 29% | 6% |

| Teletext.ch | 25% | 6% |

| Bluewin news | 23% | 6% |

| Tribune de Genève online | 16% | 5% |

| Yahoo News | 13% | 3% |

Overview of key findings

By Mario Schranz, Mark Eisenegger, Linards Udris

Research Institute for the Public Sphere & Society, University of Zurich

The Swiss media market is small and highly fragmented, subdivided into a large German-language media market, a smaller French-language market in the west as well as a very small Italian-language market in the south of the country, with the media markets of these three language regions further subdivided. 1

At the same time, media ownership in Switzerland is highly concentrated. There are two large providers: the PSB SRG SSR, present in all parts of the country with its TV and radio programmes (German-language SRF, French-language RTS, Italian-language RSI), and the Swiss publishing house Tamedia AG, present in all three main language regions with its nationwide free paper 20 Minuten, 20 Minutes and 20 Minuti respectively.

Tamedia has acquired many larger and smaller regional newspapers in the last decade such as 24heures and the tabloid Le Matin (giving it almost 40% market share of the press market in the German-speaking region and over 60% in the French-speaking one). [52. http://www.foeg.uzh.ch/dam/jcr:ffffffff-dcb0-8a8e-0000-0000635a6531/Broschur_Jahrbuch_foeg_englisch_2015.pdf Its Tages-Anzeiger is also a highly respected supra-regional daily newspaper.

Other significant media players include the NZZ media group, with its Neue Zürcher Zeitung, a nationally and internationally highly regarded daily newspaper, as well as with regional newspapers in eastern and central Switzerland, and the multimedia group Ringier AG with its various on- and offline issues of the tabloid Blick and the respected French-speaking daily newspaper Le Temps.

Switzerland has no significant private broadcasters on the national and language level, but the influence of broadcasters from the large neighbouring countries (France, Germany, and Italy) is very strong. Digital news as an information source has grown rapidly in Switzerland, in particular the news websites of the free papers, the tabloid press as well as the public broadcaster SRG SRR. There are few successful digital-born brands, with the exception of German-language website Watson.ch, launched in 2014, and Bluewin.ch – a news offering from the state-run telecom company Swisscom. International titles such as the Huffington Post and BuzzFeed play a limited role in Switzerland.

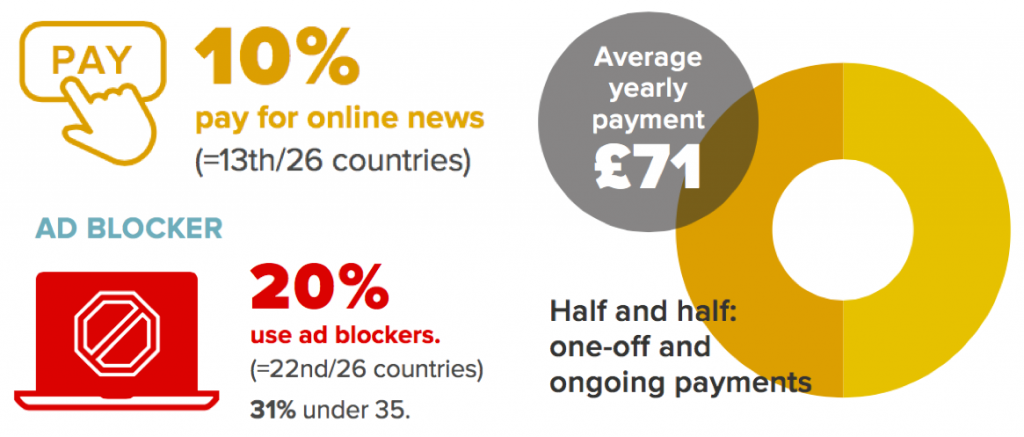

The newspaper sector continues to suffer from declining advertising and sales revenues, which are not even close to being compensated by gains made online. [53. https://www.werbestatistik.ch/ Indeed, the willingness of consumers to pay online is just below the European average, and the use of ad-blockers is also relatively widespread.

Despite these problems, Tamedia AG achieved a record profit for 2015, and the NZZ media group also published good results. A significant part of Tamedia’s growing profit, however, is due to activities that don’t relate directly to news such as directory services and real estate listings.

Even so many Swiss publishing houses are focused on digital innovation. Tamedia AG created a new division called ‘Digital News & Development’ and the NZZ group has adopted a new management structure. Both NZZ and Ringier’s tabloid medium Blick are participating in Facebook’s Instant Articles initiative, while NZZ is working with the Blendle news platform and has launched new digital news offerings (e.g. fm1today.ch and nzz.at, a new online offering for the Austrian market). Last year, Tamedia AG launched the 12-App, which makes the best articles from various media titles available via a new digital subscription.

Echoing the situation in many other European countries, political pressure on the PSB SRG SSR increased greatly last year. A government report to be published this year will describe the future role of the public news service. In addition, right-wing populist politicians have intensified political pressure and launched a popular initiative which aims to abolish the provision of public funds to the public news service altogether.

Paying for news

The introduction of (metered) paywalls to certain online offerings of the Tamedia and NZZ publishing houses has not yet had the desired impact on revenues – though average payment levels are amongst the highest in our survey.

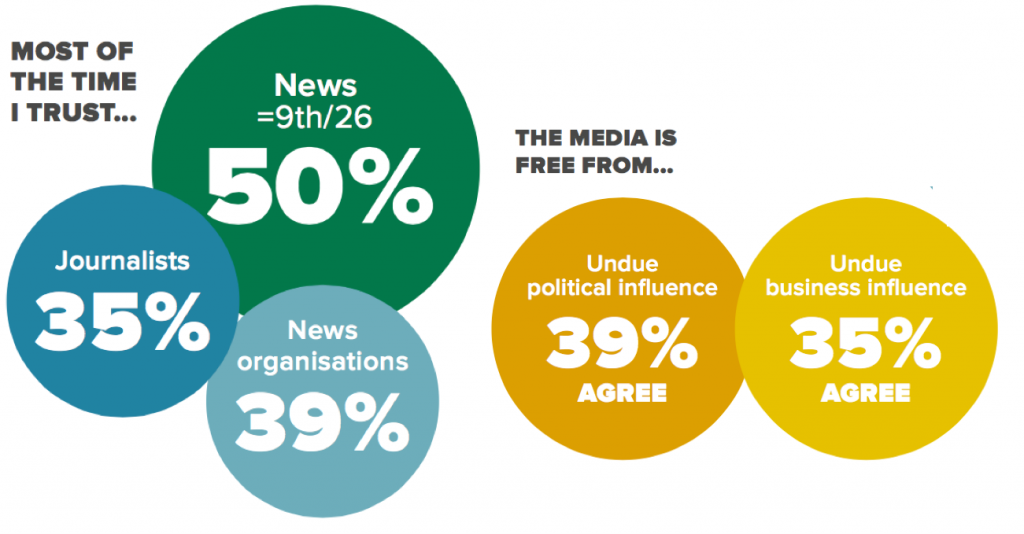

Trust

Trust in the news in Switzerland is high compared with other countries, although trust in media organisations has suffered. Possible reasons include the overt campaigns against the public broadcaster, the increasing party-political positioning of some news brands, and the growth in the importance of the tabloid and free media in recent years.

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 36% | 44% | |

| 2 | 19% | 23% | |

| 3 | YouTube | 19% | 23% |

| 4 | Google+ | 6% | 4% |

| 5 | 6% | 6% |

- http://web.archive.org/web/20170606133330/http://ejc.net/media_landscapes/switzerland – We only surveyed German and French speakers. ↩