United States

| Statistics | |

| Population | 319m |

| Internet penetration | 87% |

The US media environment is highly commercial, highly competitive, and increasingly fragmented – with a diverse set of legacy publishers increasingly challenged by newer digital outlets.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| Local television news | 33% | 13% |

| Fox News | 31% | 17% |

| NBC/ MSNBC News | 25% | 8% |

| ABC News | 24% | 6% |

| A regional or local newspaper | 24% | 6% |

| CBS News | 24% | 5% |

| CNN | 24% | 7% |

| Local radio news | 18% | 4% |

| BBC News | 10% | 1% |

| City paper (e.g. Boston Globe, Chicago Tribune etc) | 9% | 2% |

| PBS News | 9% | 1% |

| NPR News | 9% | 3% |

| New York Times | 8% | 2% |

| USA Today | 8% | 1% |

| A free city paper such as Metro | 6% | 1% |

| Washington Post | 5% | 1% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| Yahoo News | 28% | 12% |

| Huffington Post | 25% | 6% |

| Fox News online | 22% | 10% |

| CNN online | 21% | 6% |

| Local television news online | 21% | 6% |

| Website of a local newspaper | 20% | 4% |

| MSN News | 17% | 4% |

| BuzzFeed News | 16% | 2% |

| NBC/MSNBC News | 16% | 3% |

| New York Times online | 14% | 2% |

| ABC News online | 13% | 2% |

| Washington Post online | 12% | 1% |

| CBS News online | 12% | 1% |

| Website of a city paper | 12% | 2% |

| USA Today | 11% | 1% |

| BBC News online | 10% | 1% |

Overview of key developments

By Emily Bell and Smitha Khorana

Tow Center, Columbia Journalism School

News and journalism have never been more popular or more difficult to monetise – with platforms run by Silicon Valley technology giants playing an increasing powerful role. Snapchat launched its Discover channels in the United States last year, providing a new distribution outlet for brands like Vice, BuzzFeed, the Wall Street Journal and Cosmopolitan. The New York Times and the Washington Post were early participants in Facebook’s Instant Articles initiative, now opened up to all publishers. Apple News launched a revamped app in June as a showcase for publishers and Google’s initiatives included the Accelerated Mobile Pages (AMP).

All this comes against a background of greater use of both smartphones and social media – with almost half of respondents in the United States (46%) now using social networks as a source of news. Facebook is by far and away the most important platform for news, both individually and corporately as it also owns Instagram and WhatsApp.

Local journalism continues to decline, with the Los Angeles Times and other Tribune papers experiencing more severe cuts to editorial staff. In April 2016 Gannett offered $815m for Tribune Co, which would represent major consolidation in the local market. The issues of scale introduced by digital advertising have been especially challenging at local level. Three Philadelphia media groups – the Inquirer, the Daily News, and news website Philly. com – were all put into a non-profit trust with the intention that this would allow both preservation and experimentation.

At the other end of the scale, American publishers sought to dramatically expand their international digital footprints. BuzzFeed launched more international editions, but also missed its 2015 revenue targets by a large margin.1 The New York Times launched a Spanish edition – The New York Times en Español in February 2016 while increasing subscriptions by 20% at home. The NYT also announced it would be investing $50m in the European market where online Washington-based Politico had also expanded with a bureau in April 2015. Both legacy brands and digital outlets alike grew their in-house design and advertising studios despite widespread scepticism about the robustness of native advertising, which now represents 22% of the online display market.

Vice launched Viceland, its own cable television channel, while both Vox and BuzzFeed have expanded into video following further investments from NBC Universal. Mashable laid off journalists, cutting international and political news as part of a strategic shift towards video.2 This push by digital media companies into television is in one sense surprising with the evidence that young people are watching less. On the other hand television companies are still generating substantial revenues and investing in digital native outlets is seen as one way of hedging against future disruption. Cable channel valuations have been hit by growing competition from streaming services like Netflix. Al Jazeera America closed in April 2016, but mobile focused AJ+ continues to thrive.

Some new digital outlets like the Marshall Project, The Intercept, and Reported.ly continued to grow, hiring journalists and editors and winning awards and legitimacy with their peers. International publishers continued to seek a presence in the US, for instance Axel Springer bought Business Insider for $442 million in November 2015.

Overall the message from American news journalism was one of dramatic change. Legacy print media and digital native newsrooms alike are seeking to disrupt the TV market as advertising drains away from pageviews and text-based formats. Television companies are seeking to escape the same fate as print by investing in new digital native brands and the unprofitable heartland of investigative and local news is seeking to remove itself from the market completely with non- profit funding models and broad-based alliances. Lurking beneath all of this is an ecosystem where Facebook, Google, Apple, and Amazon control the advertising and technological environment.

Changes in media usage 2013–2016

Print newspapers in the US have been hit hard by falling circulation and advertising. Online competition is fierce with social media use up from 27% to 46% in three years.

WEEKLY REACH PER DEVICE

| Computer | Smartphone | Tablet | |

|---|---|---|---|

| 2013 | 77% | 30% | 17% |

| 2014 | 68% | 31% | 19% |

| 2015 | 64% | 44% | 21% |

| 2016 | 62% | 48% | 24% |

SOURCE OF NEWS 2013–16

| TV | Online (inc. social) | Social | ||

|---|---|---|---|---|

| 2013 | 72% | 47% | 75% | 27% |

| 2014 | 68% | 37% | 74% | 34% |

| 2015 | 64% | 27% | 74% | 40% |

| 2016 | 66% | 26% | 73% | 46% |

Paying for news

The headline percentage is down 2 points from last year with some newspapers abandoning paywalls and paid apps. But most of those paying have an ongoing subscription.

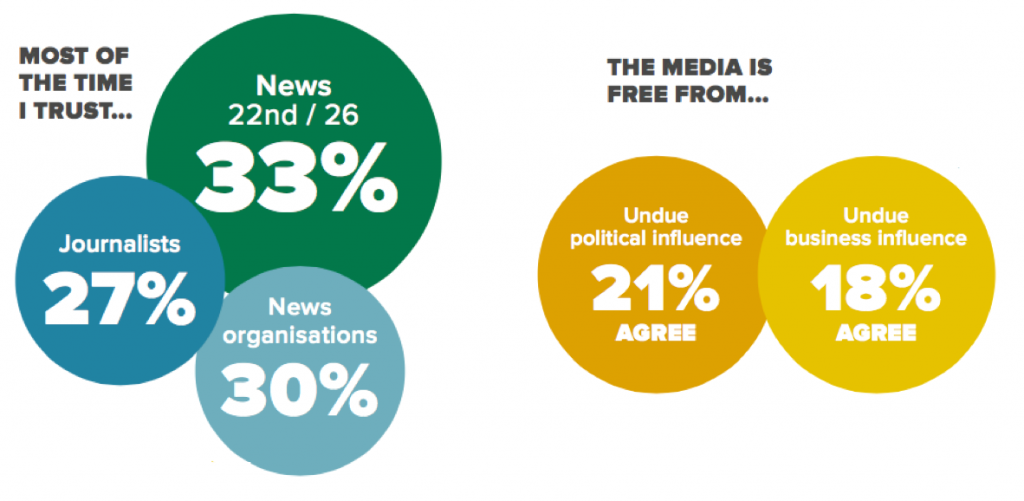

Trust

As political polarisation has increased in the run-up to the 2016 election, trust in the media has become a major issue for citizens. There is an increasingly fragmented media landscape – to the extent that critiques of ‘the media’ have become a central part of the Republican platform for certain candidates.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 45% | 51% | |

| 2 | YouTube | 19% | 24% |

| 3 | 10% | 15% | |

| 4 | 4% | 8% | |

| 5 | 3% | 3% |

- FT, ‘Buzzfeed slashes forecasts after missing revenue targets’ (16 Apr.). ↩

- http://www.adweek.com/news/television/mashable-staffers-laid-site-pushes-further-video-170669 ↩