Executive Summary

This year’s report adopts a new format which highlights the views of digital leaders on the key issues facing the news industry and combines this with five forward-looking contributions from the Reuters Institute. The main purpose is to provide useful insights for the year ahead and to identify the most important media trends.

The last ten years were defined by the twin technological disruptions of mobile and social media, which fragmented attention, undermined advertising-based business models, and weakened the role of journalistic gatekeepers. At the same time, social and political disruptions have affected trust in journalism and led to attacks on independent news media in many countries. The next decade will be defined by increasing regulation of the internet and attempts to re-establish trust in journalism and a closer connection with audiences. It will also be rocked by the next wave of technological disruption from AI-driven automation, big data, and new visual and voice-based interfaces. All this against a backdrop of economic and political uncertainty which will throw up further challenges to the sustainability of many news organisations.

But how do media leaders view the year ahead?

• Most industry executives say they are confident about their own company’s prospects but are much less sure about the future of journalism. Local news provision is a key concern, alongside fears about declining trust and attacks on journalism by politicians.

• The majority of respondents (85%) think that the media should do more to call out lies and half-truths, but some worry that this might not be enough as more politicians around the world pick up Donald Trump’s media playbook, undermining mainstream media and using social media to push messages directly to supporters.

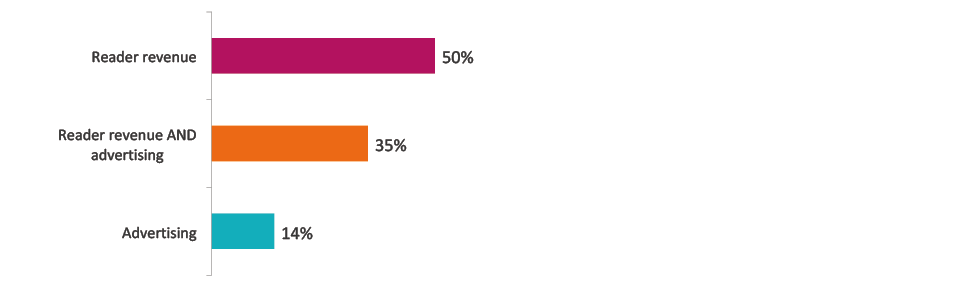

• Publishers continue to bet strongly on reader revenue, with half (50%) saying this will be their main income stream going forward. Around a third (35%) think that advertising and reader revenue will be equally important, with just one in seven (14%) pinning their hopes on advertising alone.

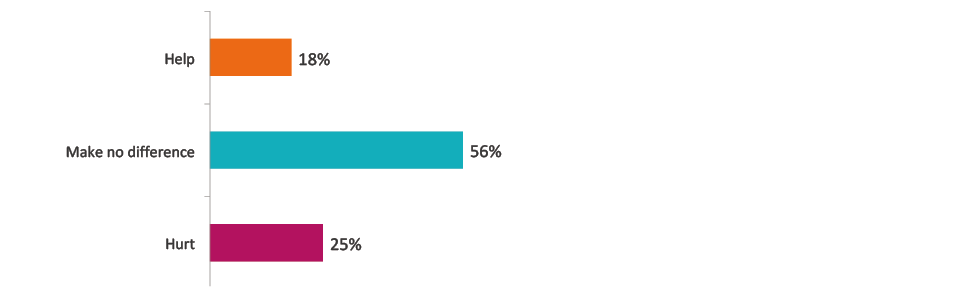

• The power of tech platforms remains an issue of great concern for most publishers. But there are mixed views on regulation. Publishers feel that interventions by policymakers are more likely to hurt (25%) rather than help (18%) journalism, with the majority feeling that it will make no difference (56%)

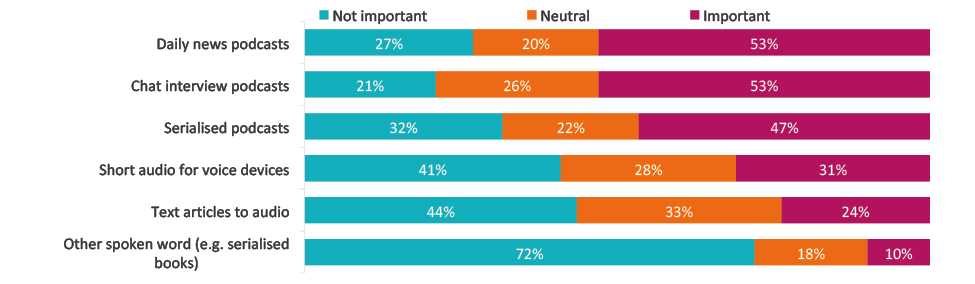

• It looks set to be another big year for podcasting, with over half of our publisher respondents (53%) saying podcast initiatives would be important to them this year. Others are looking at voice and turning text articles into audio as a way of capitalising on the growing popularity of audio formats.

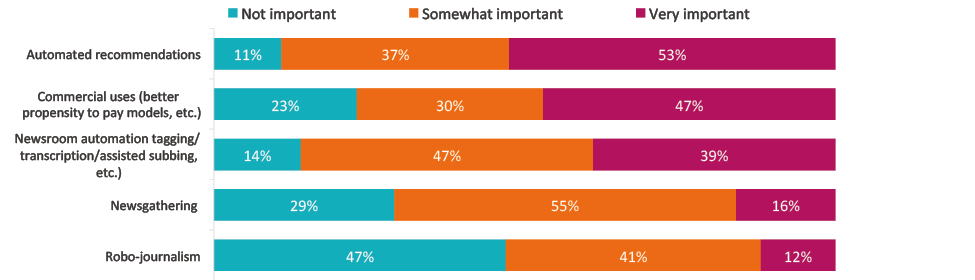

• We’re likely to see more moves by news organisations to personalise front pages and pursue other forms of automated recommendation this year. Over half of our respondents (52%) say these AI-driven initiatives will be very important this year, but smaller companies worry about being left behind.

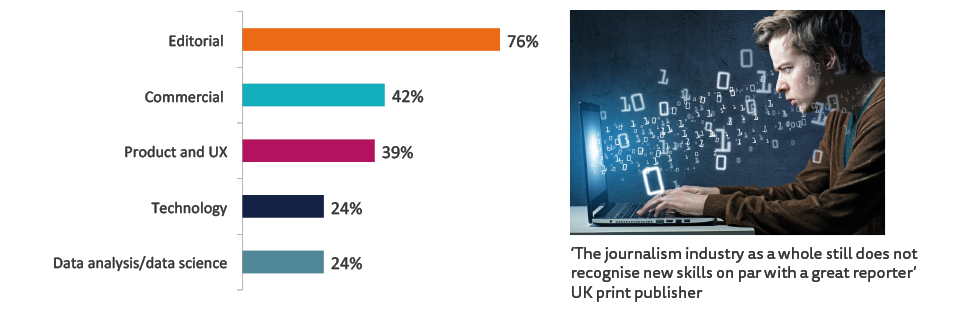

• Attracting and retaining talent is a major worry for news organisations, especially in technology areas. Less than a quarter of respondents say they are confident about keeping data scientists and technologists (24%) compared with 76% for editorial staff. Tech companies and consumer brands can often offer higher salaries, more job security, and a culture within which they can do their best work.

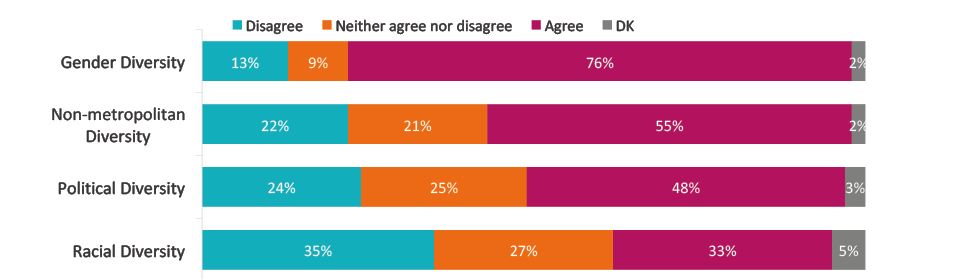

• Publishers and broadcasters say they have made big strides over gender diversity in the newsroom, with three-quarters (76%) believing their organisation is doing a good job. However, they rate themselves less well on geographical (55%), political (48%), and racial diversity (33%).

On the cards in 2020 …

• More websites will demand registration details in return for content this year. Collecting first-party data will become a key focus for publishers, following reduced cookie support from leading browsers and tightening privacy regulations. But this risks putting further barriers in the way of casual news users.

• Elections around the world will be another chance for purveyors of misinformation and disinformation to try new tactics, including AI technologies, to overwhelm platform defences. The role of platforms will be increasingly politicised, with direct attacks and accusations of bias from prominent politicians.

• Better, more immersive, feature-rich headphones (e.g. AirPod Pro and similar devices) will prove the big tech hit of the year and give a further boost to audio formats.

• 5G networks will continue to roll out in cities around the world this year, though handset availability remains limited. Ultimately 5G will enable faster and more reliable smartphone connectivity, making it easier to access multimedia content on the go.

• Transcription, automated translation, and speech-to-text text-to-speech services will be some of the first AI-driven technologies to reach mass adoption this year, opening up new frontiers and opportunities for publishers.

This report is supplemented with the following essays:

- Building the Business we Want (Rasmus Kleis Nielsen)

- Journalism under Fire (Meera Selva)

- Trust will Get Worse Before it Gets Better (Richard Fletcher)

- Handling Inter-Generational Tensions in News Media (Lucy Kueng)

- Making Readers Pay (Eduardo Suárez)

1. Key Trends and Predictions for 2020

In this section we explore key themes for the year ahead, integrating data and comments from our publishers’ survey. For each theme we lay out a few suggestions about what might happen next.

1.1 Business Outlook More Positive than for Years, but Worries about Journalism Persist

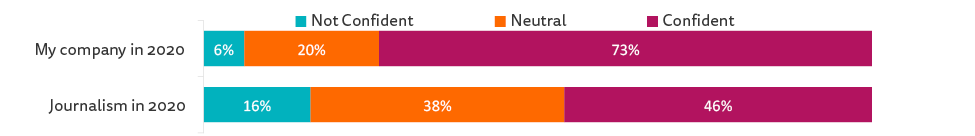

Almost three-quarters of our respondents (73%) say they feel confident or very confident about their company’s prospects in 2020. It’s a surprisingly upbeat assessment given continuing editorial and commercial uncertainty but reflects optimism amongst many publishers that reader revenue and diversification strategies are starting to pay off.

These same media executives, however, are less confident about journalism in general (46%) and public-interest journalism in particular. There is widespread disquiet about the decline of local news and the economic and political pressure on journalists trying to hold the rich and powerful to account.

I’m worried that local, legacy newspapers are buffeted by corporate debt, declining ad revenue and a slow transition to digital revenues.

–Jeremy Gilbert, Director Strategic Initiatives, Washington Post

It is depressing and concerning to witness the continued attacks upon the free media by heads of state.

–Karyn Fleeting, Reach plc, UK

Confidence in my company/the state of journalism

Q1/2. To what extent are you confident about your company’s prospects/journalism’s prospects in the year ahead? N=230

One notable trend is lack of confidence from public service broadcasters (PSBs), many of whom face rapidly falling audiences for linear output, growing competition from Netflix and Spotify, and, in many cases, attacks on news output from populist politicians and commercial media owners. Average confidence from respondents from a PSB background was just 46% compared with the overall average of 73%. These numbers are influenced by recent or upcoming budget cuts in a number of countries, including Denmark, Australia, and the UK.

Reader Revenue Focus

By contrast, commercial media, especially those at the quality end of the market, are increasingly confident about the future of paid content, with both large and small companies hitting important milestones in the past year. The New York Times has 4.9 million digital and print subscribers, almost halfway to its 10 million goal.1 The Financial Times broke through its 1 million subscriber target, while the Guardian returned to profit – after years of heavy losses – off the back of more than 1 million reader contributions over the past three years.2 News executives across many countries tell us that reader revenue is providing stable and growing income while advertising has remained volatile, with many reporting worse than expected results in 2019.

Growth engines, reader revenue specifically, has very positive prospects; advertising revenue remains a major concern.

–Jon Slade, Chief Commercial Officer, FT

Most important revenue stream for my company going forward?

Q3. Thinking about your own company, which of the following statements do you agree with most. Reader revenue will be the most important revenue stream going forward/reader revenue and advertising will be equally important/advertising will be most important. N= 189

But it is not just big companies that are making reader revenue work. Smaller publications are also finding success through a variety of subscription and membership models. Investigative news site Follow the Money in the Netherlands and slow-news operation Zetland in Denmark are amongst those hitting tipping points around profitability:

Due to a very successful ambassador campaign (member-get-member) this year we had a 25% growth in August and our budget is now for the first-time balancing.

–Lea Korsgaard, Editor in Chief, Zetland, DK

We have solid base of subscribers and we know [this] makes our audience grow and keeps our churn low. We are convinced that the subscription model is future proof.

–Jan-Willem Sanders, Publisher, Follow the Money, NL

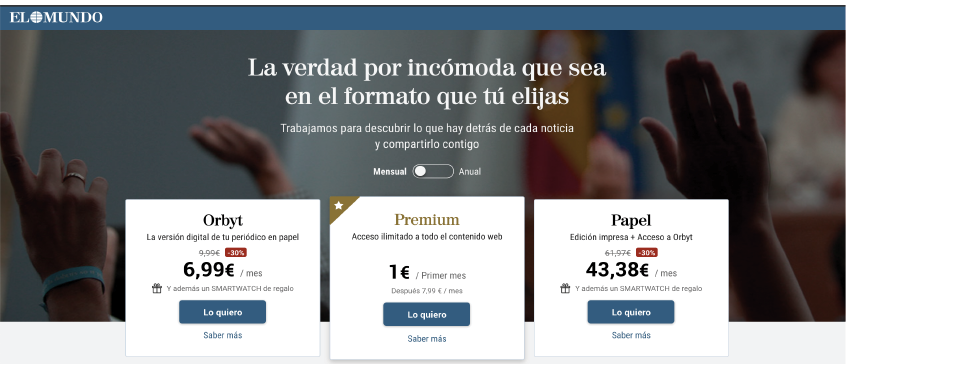

This year will see southern European media houses leaning more into subscription. In Spain, El Mundo has already started to charge for premium content, with El País set to follow early in 2020. It is already asking readers to sign in (for free) to read opinion and weekend features in preparation for the change. This is a major shift of direction for publications that until recently have pursued a scale-based strategy (which has sometimes led to accusations of clickbait and low-quality journalism).

Payment options at El Mundo

Other regional chains such as Vocento and Prensa Ibérica have established paywalls in most of their titles, while the independent sector is strengthening membership and or donation options.

What to Expect in 2020?

Crumbling cookies? Publishers will be pushing aggressively ahead with registration and log-in strategies following data privacy regulation and tightening restrictions on cookies by anti-ad-tracking browsers like Safari and Firefox. First-party data will be at a premium going forward but this is likely to further benefit platforms like Google and Facebook, which have hundreds of millions of authenticated and logged-in users. By contrast individual news publishers may struggle to persuade consumers to keep logging in. Expect more publisher alliances, like NetID3 in Germany and Nonio4 in Portugal, to counter this trend.

More consolidation. Declining margins in the face of falling readership and growing platform power have already led to a series of mega mergers, leading to new questions around plurality and concentration of ownership. US-based regional newspaper chains Gannett and GateHouse Media combined forces in November to create a conglomerate that will own around one in six daily titles in the US. Vice acquired Refinery 29 and Vox Media bought New York Magazine in eye-catching deals that create both scale and complementary audiences. In the UK the group that owns the Daily Mail added the i newspaper to a stable that includes the Metro freesheet – giving it around 30% of the national newspaper market. Troubled regional publisher JPI Media is up for sale, likely to be bought by Reach plc or Newsquest, and national broadsheet the Daily Telegraph is also rumoured to be on the market. In the past many of these mergers have destroyed value, so the focus is likely to be on keeping editorial propositions distinct while integrating back-end systems like technology, data, and ad tech.

Editorial partnerships. With publishers realising that they can’t cover every option, they are increasingly looking for partnership opportunities. In the recent UK election, Sky News teamed up with Buzzfeed News to help tap into the social conversation. In return Buzzfeed got access to brand exposure with a much bigger audience. In podcasting, partnerships are the order of the day, with Gimlet working with the Wall Street Journal and Slate and The Economist getting together to produce the Secret History of the Future.

Subscription avoidance. With more publishers after our money, people will encounter more and more paywalls, and consumers will be increasingly aware of how to get around them. Most people are willing to subscribe to only one or two digital sources of news,5 but might still be interested in accessing more. Loopholes around incognito browsing are increasingly being closed by registration strategies, but sophisticated paywall blockers are emerging that can open up all but the most secure websites. Consumers will also become savvier about looking for special deals at renewal time.

See also

Rasmus Kleis Nielsen, ‘Building the Business We Want’

Eduardo Suárez, ‘Making Readers Pay’

1.2 Post-Truth Politics and the Journalistic Response

The UK election was yet another example of politicians playing fast and loose with the facts, avoiding journalistic scrutiny, and denigrating the media. ‘It’s been the most shallow, mendacious and frustrating election I can remember and a bad advertisement for democracy,’ declared veteran political analyst Peter Kellner.6 The UK’s independent fact-checking organisation, Full Fact, said the six-week campaign saw ‘inappropriate and misleading campaign tactics that we hadn’t seen before’. These included an official Conservative Party Twitter account impersonating a fact-checking organisation and editing footage of a Labour politician to make it look as if he couldn’t answer a question about the party’s Brexit policy.

The media integrated fact-checking into coverage and scrutinised politicians wherever possible, but these TV interviews and debates are watched by fewer and fewer people. Politicians are increasingly trying to bypass the media and convey messages directly via social media. Boris Johnson declined an invitation to be interviewed by the BBC’s toughest interviewer Andrew Neil and hid in a fridge to avoid another TV interview. Channel 4 replaced Johnson with a melting ice sculpture when he refused to turn up for a leader debate on climate change. In the wake of these challenges, the Tories briefed journalists that they would review both Channel 4’s broadcasting licence and the funding mechanism for the BBC.7

In our survey, 85% agreed with the proposition that the media should do more to call out lies and half-truths, but it is not clear that this approach cuts through with audiences, and it may even be hardening criticism of the media from both left and right.

The news media should do more to call out misleading statements and half-truths by politicians

Q7. To what extent do you agree with the following statement: The news media should do more to call out misleading statements and half-truths by politicians. N=223

As more politicians around the world pick up Donald Trump’s media playbook, these dilemmas will become more acute in the year ahead. The media have become more robust in aggressively fact-checking since the events of 2016, but a number of publications that run these teams told us they fear this is not having ‘any impact on large parts of the public’.

The lack of consequences for a President who lies repeatedly has only emboldened a generation of politicians to give up any commitment to truthfulness. It’s grim out there.

–Leading US publisher

See also

Meera Selva, ‘Journalism under Fire’

But responses are not obvious and the news media often don’t help by sometimes or often repeating or amplifying lies and misleading narratives. Even among those who try to challenge falsehoods and blatant spin, publishers worry that devoting time to fact-checking can divert resources and attention from other journalistic endeavours. Others say that there is often a fine line between ‘calling out a statement and perceptions of partisanship’, which may undermine trust with readers, listeners, and viewers. The media might also take note of our own research which shows that the public often feels that politicians (and other public figures) often don’t get a fair hearing8 and that the media takes an overly negative view of events.9 Some hope for a more nuanced response than just calling out politicians in the year ahead:

We certainly need to offer fact checks and reality checks. But we also need content which explores good faith politics, what might be working, how policy develops and makes a difference. Otherwise we will push our audiences to disengage and distrust politics even more.

–Mary Hockaday, Controller, BBC World ServiceI’m always optimistic about the industry – but this year I worry more about reader fatigue and news avoidance than I ever have before. Clearly this is a problem for democracy and debate, not just for the industry.

–Sarah Marshall, Head of Audience Growth, Conde Nast

The issues of disengagement and news avoidance are a growing concern for many executives. Countering cynicism and negativity is likely to become a more important theme for journalists in the year ahead.

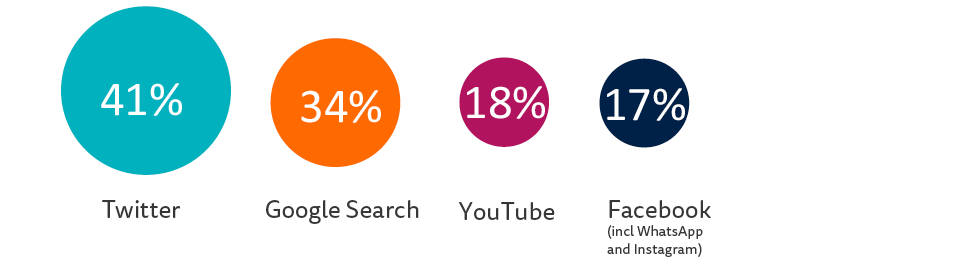

Platform Responsibility

Journalists are as critical of tech platforms as they are of politicians when it comes to misinformation and disinformation. In this year’s survey they are damning in their verdict about platforms’ attempts to clean up the problem. Less than one in five (17%) gave Facebook credit for their efforts in the last year, despite it removing billions of accounts, stepping up funding for fact-checking, and increasing transparency around political advertising. YouTube rated at just 18% in a year when it has promoted reputable sources around breaking news events and introduced new information panels flagging misinformation. Google search rated marginally better at 34%, after changes to its algorithms that have surfaced more original and local journalism in results. Twitter scored 41%, possibly due to their recent stance on banning all political advertising on its platform.

How publishers rate platforms in the fight against misinformation

Percentage rating 3, 4, or 5 (average or above)

Q8. To what extent do you think that the following platforms have done enough in the last year to combat misinformation and disinformation? N=221

But the overall message from publishers is that these efforts are nowhere near enough to combat the scale and scope of the problem.

All the tech platforms spend a tiny fraction of their vast revenues and technology resources on this area, despite fair, transparent media being an absolutely vital ingredient of a healthy, functioning democracy. Most of their efforts feel like lip service to appease regulators.

–UK publisher

Our survey also reveals the different approaches between Europe and the US in terms of where the limits of free speech should lie.

Most platforms still hold the position ‘if it’s not criminal, it’s free speech’, which is unacceptable. Once more, they take the money, and leave the costly work (fact-checking, counter-arguing, etc.) to journalists from media outlets.

–Vinzenz Schmid, Strategy, SRG SSR, Switzerland

It is hard to separate the responsibility of platforms from the wider tensions in society that are fuelling these trends. And without clear guidance on the limits to free speech Silicon Valley companies are increasingly being asked to make more editorial judgements on which content should be removed or demoted. Whatever they do, it is hard to see platforms pleasing publishers or politicians in 2020.

What to Expect in 2020?

Platform regulation bites. In some countries (e.g. the UK) we are likely to see a new technology regulator this year with powers to oversee an enforceable code of conduct for the biggest players, such as Facebook and Google, and new rules to give consumers more control over their data. But issues around free speech and elections will be much harder to regulate. Politicians will largely duck these challenges again in 2020.

US election focus. Social media will be in the spotlight in the run-up to the November presidential election, with coordinated campaign activity and increasingly vocal accusations of platform bias from the right as well as some voices on the left. Expect more smears against candidates and attempts by domestic actors to create coordinated campaigns across networks – and for arguments to rage about whether false or misleading political messages should be fact-checked or given less prominence. Closed groups on Facebook and WhatsApp, where it is harder to monitor and rebut false information, will become an increased area of focus.

1.3 Platforms and the Relationship with Journalism

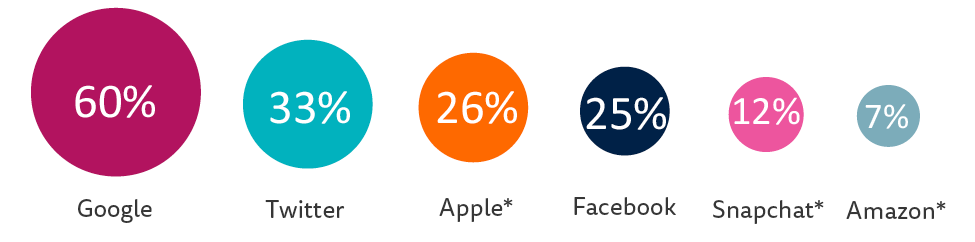

Our digital leaders survey shows publishers remain more positive about Google and Twitter than Apple, Facebook, Snapchat, and Amazon when it comes to initiatives to support journalism. Over half of respondents rated Google as average or better but all other platforms attracted more negative than positive sentiment, and there is a considerable amount of cynicism about underlying motives across the board.

How publishers rate platforms in supporting journalism

Percentage rating average or above on five-point scale (3,4, or 5)

Q9. To what extent do you think that the following platforms have done enough to support journalism? N=221

*these figures are low partly due to large number of don’t knows – 13% for Apple, 26% for Amazon, 38% Snapchat, compared with just 2% for Google and 3% for Facebook.

Google’s higher score is reflective of the large number of publishers in our survey who are current or past recipients of Google’s innovation funds (DNI or GNI), and who collaborate with the company on various news-related products. Facebook’s lower score may reflect historic distrust from publishers after a series of changes of product strategy which left some publishers financially exposed. In the last year, however, Facebook has stepped up its commitment to journalism, with several new product initiatives as well as a commitment to invest around $300m in journalism-related initiatives over the coming years.

The overall sense from our survey, however, is that publishers do not want hand-outs from platforms but would prefer a level playing field where they can compete fairly and get proper compensation for the value their content brings.

Few of the platforms take the business of journalism seriously. Funds and small bits of industry engagement won’t cut it. The industry needs real and meaningful business models for journalism. Apple News+ achieves the opposite, which is profiteering for Apple while conditions for publishers are appalling.

–Global publisher

Policymakers continue to talk about different kinds of intervention to help the news industry. These include enforcing the EU’s new copyright directive, often referred to as the ‘link tax’ because it requires platforms to pay for unlicensed content that appears in aggregated news services. The process is a direct result of lobbying by big publishing houses but got off to a rocky start in France, the first member state to implement the directive, with Google opting to display less information in search results rather than set a costly precedent. With publishers turning to the courts and both sides digging in, the only guaranteed winner this year is likely to be the legal profession.

More positively, the EU has already taken other action to help news organisations, including allowing member states to exempt digital publications from VAT, while a number of governments around the world are looking at issues of transparency and excessive fees in the digital advertising market. As we have documented in a recent report, policymakers have a range of actionable options if they want to create a more enabling environment for independent professional journalism, including steps to protect media freedom, enhance the sustainability of the news business, and help the industry and the profession work towards its digital future.10

Whether policymakers will take such steps remains an open question but in our survey publishers feel that interventions are more likely to hurt journalism (25%) rather than help it (18%), with the majority feeling that it will make no difference (56%).

Will policy making interventions help or hurt journalism this year?

Q13. Do you expect policymaker interventions to help or hurt journalism this year? N=217

What to Expect in 2020?

Facebook’s News Tab goes global. As this rolls out beyond the United States, we can expect more arguments about who should be included and how much publishers should be paid. Perhaps the bigger question, though, is whether consumers will show any attention to a walled garden full of tried and trusted news brands. Our own research suggests news is more of an incidental part of the Facebook experience rather than a destination for news, and it may be hard to shift those behaviours. Mark Zuckerberg’s publicly stated goal is for tens of millions of users – just a small percentage of Facebook’s 2 billion global user base.

Controlled off-platform news. Facebook’s news tab is part of a wider trend, with platforms looking to create trusted and curated environments for news rather than mixing it with user-generated content. YouTube have started to inject trusted brands into the feed when big stories break and Google’s carefully selected news index does a similar job for AI-driven products like Discover. We’re also seeing more humans involved in the process, with platforms hiring editors to manage the nuances.11

1.4. Diversity and Talent in the Newsroom

In the last few years, the industry has woken up to the lack of diversity in newsrooms and the difficulties this creates in representing societies fairly and accurately. Much of the recent focus has been on gender, following the #MeToo movement, the exposure of pay gaps in the UK, and deep-seated sexist attitudes in French newsrooms. But there has also been soul-searching after Brexit, Donald Trump, and the Gilets Jaunes protests about the lack of political diversity in journalism and the failure to understand concerns of those outside the big cities.

Our publisher respondents say they have made big strides over gender diversity, with three-quarters (76%) believing their organisation is doing a good job. However, they rate themselves less well on diversity from non-metropolitan areas (55%), on political diversity (48%), and on racial diversity (33%). Critics will argue that these relatively high figures reveal complacency amongst news executives and that much more still needs to be done.

My news organisation is doing a good job with …

Q5. To what extent do you agree with the following statements? N=227

Within these averages we can detect significant regional differences, with Scandinavian publishers much more confident about gender diversity than publishers in other parts of Europe. Overall, women were much more sceptical about the rate of progress than men:

In France … we are particularly bad at diversity issues. I think this awareness is not yet at the right level in my newsroom.

–Top French print publisher

Others report progress at more junior levels, but with editorial decision-making often still in the hands of men:

Portuguese media is very gender balanced … except when it comes to editors in chief.

–Catarina Carvalho, Executive Editor, Diario de Noticias

There was widespread recognition in our survey about the need to expand recruitment beyond liberal urban elites. Digital-born brands in particular have used remote working to help increase diversity, but in countries like South Africa remote working is harder to pull off and the economics often don’t stack up:

Pressure on costs and a very disparate geographical country mean it is difficult to sufficiently cover outlying areas, and most media outlets focus on the metro areas.

–South African publisher

A recent RISJ report on diversity and talent12 concludes that journalists must reach out to audiences that are becoming more and more diverse, while newsrooms need to be made attractive to new entrants who have to be convinced that the news business has a future.

Our survey shows that publishers feel this is going to be easier in editorial areas (76% confidence) than in data science/technology (24%), or product (39%). Here, there is intense competition with tech platforms and consumer brands who can often offer higher salaries, more job security, and a culture within which individuals can do their best work.

The competition for tech and data talent is intensifying. Google and Facebook are hiring relentlessly in London. In 2019 we lost a number of team members directly to them, but indirectly we also see significant upward pressure on salaries.

–UK publisher

Confidence about attracting and retaining talent in different areas

Percentage saying extremely or very confident

Q6. How confident are you that your organisation can attract and retain the talent you need in the following areas? N=225

Despite the general confidence over editorial retention, there are some hot spots. The Athletic, when it launched its sports subscription service in the UK, hoovered up some of the best national and regional talent, reportedly doubling the salaries of many reporters in the process. Another difficult area is audio, where there is a fight for on-air talent and the best podcast producers, with publishers and broadcasters competing with tech platforms like Spotify and independent studios.

We are less confident about younger editorial staff (below 30). They tend to drift toward podcasting and pure digital players and away from more text-based newsrooms.

–Troels Jørgensen, Digital Director, Politiken

Overall, many publishers are holding on to the hope that the ‘excitement of working in media and being able to have a positive societal impact’ will continue to attract talent even when pay and material conditions are better elsewhere.

What to Expect in 2020?

Initiatives to increase diversity. Some news organisations have started to impose their own targets for gender balance in terms of contributors. The BBC’s 5050 project started as a grassroots project with 500 teams joining voluntarily and the vast majority of these (75%) hitting these targets.

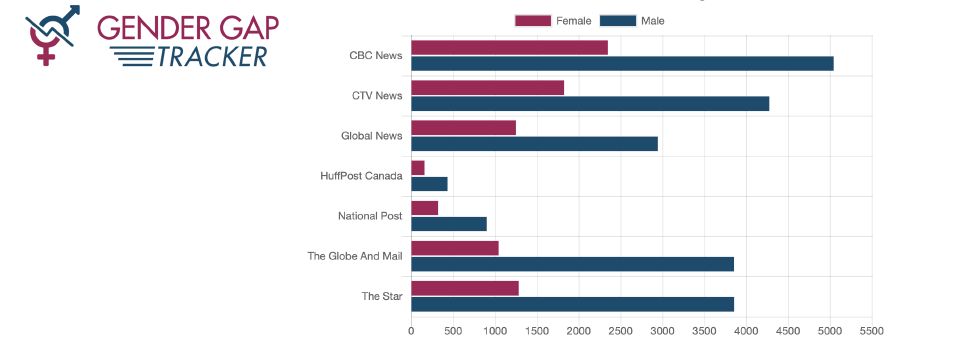

More software tools to help measure diversity. Elsewhere, online sites are being increasingly supported by software tools that give real-time readouts for editors. We’re likely to see more external monitoring of media performance this year as with this gender gap tracker of the Canadian media (currently showing an over-representation of male contributors in top outlets). Expect these tools to start to illustrate lack of diversity in other areas too.

Ratio of male and female sources by news outlet

See also

Lucy Kueng, ‘Handling Inter-Generational Tensions in News Media

1.5 New Golden Age of Audio, but Where’s the Cash?

It looks set to be another big year for podcasting, with over half of our publisher respondents saying they would be pushing various types of podcast initiative this year. Our recent report on News Podcasting and the Opportunities for Publishers13 found that the success of the Daily from the New York Times – and growing interest from blue-chip advertisers – was encouraging publishers. We identified 60 daily news podcasts in five countries, the majority of which started in the last 18 months – and more are on the way. The Times of London is one of many that will launch a daily news podcast in 2020. Others are investing in chat/interview formats or documentaries, with Le Monde, for example, recently releasing three new podcast series adapted from investigative articles.14

Important audio initiatives for 2020

Q10. There are new opportunities opening up in audio and voice with growing audiences and advertising revenue, to what extent will the following initiatives be important for your company in 2020? N=217

Bigger audiences, better measurement, and easier access have combined to change the economics of news podcasting. In turn this is encouraging publishers to invest in creating more quality content and platforms to invest in better distribution and monetisation, in a virtuous circle of growth. Publishers see podcasting as a chance to attract younger audiences, build habit, and bring in additional revenue.

In the US podcasting revenue is projected to grow by around 30% a year to reach over $1bn by 2021,15 but elsewhere revenues have been slower to build and, despite the clear audience opportunity, many publishers are still holding back:

The problem [with] audio is the difficulty of monetisation, since advertisers are currently not investing in Spain.

–Vicente Ruiz Gómez, Managing Editor Digital, El Mundo, SpainAudio and voice feels increasingly important but we’re still some way from generating enough engagement or revenue to provide any sort of return on the not inconsiderable investment required to do it to any reasonable standard.

–National publisher, UK

Subscription-based organisations are holding back for different reasons. There are few opportunities to make premium audio work – and little platform focus in this area. Meanwhile broadcasters have no option but to invest in a range of audio-on-demand options to protect their market position and to attract younger and diverse audiences. Public broadcasters are experimenting with new on-demand audio for voice devices, developing short bulletins and trialling interactive formats. The BBC is investing hard, along with NPR, ABC in Australia, and Swedish Radio (SR), but there is huge concern that platforms will use this content to build their own businesses in this area.

This year we’ll see further tension between broadcasters and platforms, with ‘content boycotts’ and a greater use of windowing strategies where content is released first on broadcaster apps.

We have ambitious plans for live, podcasts, and news clips. The strategic choice ahead is how much to do and release to external platforms like Spotify and Google.

–Olle Zachrison, Head of News, Swedish Radio

The international roll-out of Google’s audio news aggregation service, and Spotify Drive, which mixes music playlists with short news audio content, could be another flashpoint. Broadcasters fear their direct connection with audiences will be lost in these aggregated services.

Some publishers are boycotting audio aggregation services from Google and Spotify

Print publishers have less to lose, though many remain wary about repeating past mistakes:

Publishers have rightly held back on providing audio content for aggregated news services, until there is a clear path towards monetisation. Google will spend money effectively licensing audio news content in 2020, so we will see whether it can become a financially sustainable news product.

–UK news publisher

What to Expect in 2020?

Podcasting beyond the English language. Much of the action so far has been confined to the US and a handful of English-speaking countries, but this is set to change. Brazil is now the second largest market for podcasting in the world, according to some measures,16 and will be a major focus for both Google and Spotify this year. Spain and France are also seeing strong audience growth and the development of independent podcast studios.

Audio articles as standard. Improved technology is enabling new opportunities for publishers in quickly reversioning text output into audio. In Canada, the Globe and Mail is one of the first publishers to use Amazon Polly, a text-to-speech service that sounds far more natural to the human ear than previous versions. Subscribers can listen to selected articles in English, French, and Mandarin and choose their favourite voice.17

In Denmark, ‘slow-news’ operation Zetland provides all its stories with a (human-read) audio option. Around 75% of all stories are now listened to rather than consumed via text (pink block in chart below) – perhaps a sign of things to come for other publishers. Meanwhile in Brazil the newspaper Estadão has teamed up with Ford to create a human-read daily audio service for Spotify. Each part of the newspaper has its own album, each news story has its own track. Many publishers see connected cars as a new opportunity to reach audiences and audio as a key way to deliver journalism in the future.

Platform wars? Apple’s dominance over podcasting is being eroded by Spotify, which has invested $500m in improving discovery and acquiring original content. It has doubled its market share in the last year in many countries18 and is looking to become the dominant platform for podcasting within a few years. But expect Apple to fight back this year, while podcast specialists like Luminary in the US, Sybel in France, and Podimo in Denmark and Germany, are all vying to become the ‘Netflix of podcasting’.

1.6 Doubts Emerging over the Role of AI in the Newsroom

A recent report from the LSE revealed myriad ways that AI (or at least machine learning) is already being deployed in journalism, at the same time as highlighting the ethical challenges that lie ahead.19 The report set out the different ways that AI is being used in (1) newsgathering, (2) production (including different kinds of newsroom automation), and (3) distribution/recommendation.

In our digital leaders survey we can see that most focus this year will be on creating more effective recommendations (53% saying very important), followed by commercial uses such as using AI to target potential subscribers and optimise paywalls (47%), and ways of driving greater efficiency in the newsroom, such as using AI to assist subbing or improve the consistency of tagging (39%). Only a minority of publishers felt that robo-journalism (12%) or newsgathering (16%) would be important areas to explore this year.

Which newsroom uses of AI will be most important in 2020?

Q11. To what extent will the following uses of Artificial Intelligence (AI) be important to your company in 2020? N=218

Some publishers make a clear distinction between editorial and non-editorial uses of artificial intelligence. The Times (of London), for example, uses the slogan ‘written by humans, curated by humans, distributed by robots’ to help focus its efforts. This year it will be extending its AI-driven recommendation engine, James, from emails to a wider range of web and app-based recommendations. Publishers have started to experiment with electronic editing assistants such as Tansa and Grammarly to automate some subbing tasks:

At the moment it is not at the stage where it can do the whole job but it can certainly do 80% of the legwork.

–Chris Duncan, MD Platform Partnerships, The Times and Sunday Times

Scandinavia-based publisher Schibsted has gone further, delegating some curation tasks to AI-driven algorithms, with semi-automated front pages for titles like Aftenposten and VG. The aim of its ‘Curate Project’ is to replicate the workflow of front-page editors to ‘free up time for more creative tasks’.20 Though some respondents worry that AI could be used by unscrupulous owners to drive further job cuts, most were optimistic that it would ultimately benefit journalism.

It is a gift, offering us economic benefit and efficiency. It doesn’t replace journalists. It allows journalists to return to their primary function of breaking stories, uncovering facts, and delivering the news.

–National newspaper editor, Canada

For others, AI is opening up new opportunities. The BBC has experimented with automated language translation, and improved synthesised voice technology in developing its Japanese video service, though the live output is currently produced manually.21 News agencies are focused more on turning financial and sports data into automated stories, expanding the speed and range of their output. The BBC used similar techniques to publish 689 semi-automated local stories in just a few hours on election night (December 2019) while the Guardian published its first automated story on Australian election funding in 2019. News agencies and business publications like Bloomberg and the Wall Street Journal have been using AI to quickly produce stories on company earnings and are looking for other ways to drive commercial benefits of data at scale:

We are at the forefront of automating news stories for machine-driven trading. We are also an industry leader with our propensity paywall, that can adjust to the likelihood of a reader converting to a subscriber.

–Edward Roussell, Chief Innovation Officer, Wall Street Journal

Despite general optimism, there were also significant concerns revealed in our survey.

Smaller publishers worry that they could be left behind due to the complexity, expense, and scarcity of skills: ‘We do not have the technical capacity or budget to cope with AI to the extent we would like,’ says Esther Alonso Rodríguez, Marketing and Development Director at eldiario.es in Spain.

Others fear that lack of understanding in the boardroom will lead to an over-estimation of the capabilities of AI today. ‘It’s great for transcription, and translation, but still hopeless at actually writing stories,’ says a senior editor who has experimented with these technologies. ‘This is like asking about the impact of spreadsheets. They are useful but don’t really change the fundamentals.’ Others warn that the industry should be careful about ‘distracting itself with trends’ when it should instead be aligning technology solutions to core strategy.

What to Expect in 2020?

AI-driven fake news. ‘AI has the potential to boost disinformation campaigns as the 2020 election cycle in the US ramps up,’ warns a senior executive from one of the biggest and most respected national news brands. AI could make it easier to produce junk news in text, audio, and video and such potentially low-quality and misleading content masquerading as professionally produced news could further reduce trust in journalism.

Bigger focus, better reporting of AI. The application of AI and the implications for privacy and democracy will be a defining issue not just of 2020 but of the next decade. But many worry that the technology will run ahead of our ability to shine a light on the way these systems are being programmed or used. Our own research finds that most news reporting treats AI as a novelty and struggles to explain the more immediate and pressing implications.22 There are signs that this could change this year with more news organisations (Tortoise Media) making AI a pillar of their coverage.

1.7. Summary

This will be year when journalism looks to regain relevance and confidence in a fragmented and uncertain world. Buffeted by economic and political pressures, media companies remain on the backfoot, but across the world we also see many positive examples of fearless journalism and business innovation.

The shift to reader payment, clearly signalled again our digital leaders’ survey, is in full swing and will extend this year to countries as diverse as Spain, Hong Kong, and Argentina. Companies there will be hoping to emulate and learn from the success of large and small publishers in the US and Northern Europe who are focusing relentlessly on keeping readers/viewers happy and are beginning to talk about news as a ‘growth business’ again. But reader payment is unlikely to work for all and will require deep commitment over time as well as new skills and processes.

With more high-quality journalism disappearing behind registration barriers and paywalls, the democratic dangers may also become more apparent in the year ahead. The fear is that serious news consumption will be largely confined to elites who can afford to pay, while the bulk of the population pick up headlines and memes from social media or avoid the news altogether.

Our survey shows that some publishers are looking to tackle these deep-seated engagement problems though solutions journalism, events, and accessible formats like podcasts. More diverse newsrooms will also help to broaden the news agenda and modernise presentation. But gaining and keeping attention without compromising on quality (and trust) remains the key challenge for the news industry.

Against this background, artificial intelligence offers the possibility of more personal and relevant news services, as well as more efficient ways of packaging and distributing content. But platforms will need to play a role too – especially in helping publishers reach new and diverse audiences. In this regard, the growth of content licensing via the Facebook News tab and Apple News+ is an intriguing development that will be fascinating to watch, despite widespread industry cynicism. For Facebook in particular this initiative will be critical as it looks to win back trust from publishers.

More widely, publishers remain resentful about what they see as unfair competition from platforms and tech companies. With regulation looming, we’re likely to see publishers pushing their rights harder than for many years, even as most of our respondents are sceptical that policymakers will actually help publishers, and as some platforms seem to be considering how important news actually is for their main products and services.

At the same time, the overwhelming mood from this year’s survey is one of quiet determination not to be distracted by the latest innovations but to focus on delivering long-term value for audiences. There is no one path to success – and there will be many publishers that do not make it – but there is greater confidence now that good journalism can continue to flourish in a digital age.

Postscript

Once again, thanks to all those who have contributed to this year’s predictions and to those who completed our digital leaders’ survey. We’d be delighted to hear from you if you have comments or suggestions for next year at:

reuters.institute@politics.ox.ac.uk

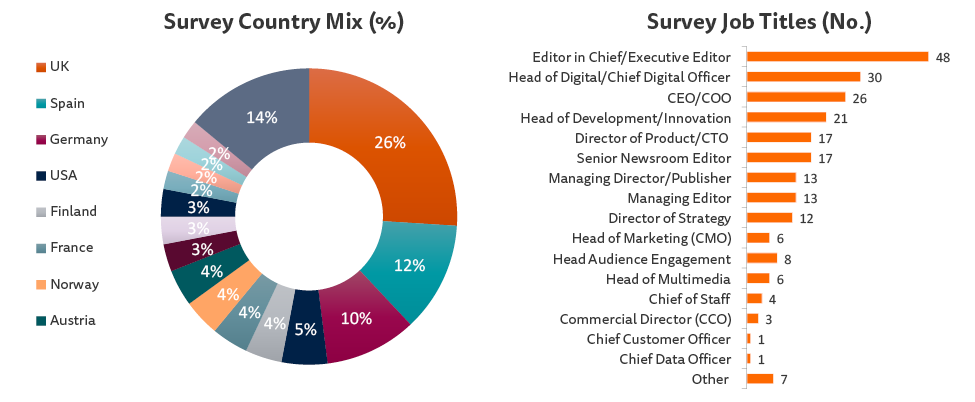

Survey Methodology

233 people completed a closed survey in December 2019. Participants, drawn from 32 countries, were selected because they held senior positions (editorial, commercial, or product) in traditional or digital-born publishing companies and were responsible for aspects of digital or wider media strategy. The results reflect this strategic sample of select industry leaders, not a representative sample.

Base = 233 Digital Leaders surveyed, 32 countries, 29 November–31 December 2019

Typical job titles included Editor in Chief/Executive Editor, CEO, Head of Digital, Head of Innovation, Chief Product Officer, Director of Multimedia ,etc. Just over half of participants were from organisations with a print background (54%), around a quarter (26%) represented commercial or public service broadcasters, more than one in ten came from digital-born media (14%), and a further 6% from B2B companies or news agencies. 32 countries were represented in the survey including the US, Australia, Kenya, South Africa, Mexico, Argentina, and Japan, but the majority came from European countries such as the UK, Germany, Spain, France, Austria, Poland, Finland, Norway, and Denmark.

Participants filled out an online survey with specific questions around strategic digital intent in 2020. Around 95% answered most questions, although response rates vary. The majority (80%) contributed comments and ideas in open questions and some of these are quoted with permission in this document

This report is supplemented with the following essays:

- Building the Business we Want (Rasmus Kleis Nielsen)

- Journalism under Fire (Meera Selva)

- Trust will Get Worse Before it Gets Better (Richard Fletcher)

- Handling Inter-Generational Tensions in News Media (Lucy Kueng)

- Making Readers Pay (Eduardo Suárez)

About the author

Nic Newman is Senior Research Associate at the Reuters Institute for the Study of Journalism, where he has been lead author of the annual Digital News Report since 2012. He is also a consultant on digital media, working actively with news companies on product, audience, and business strategies for digital transition. He has produced a media and journalism predictions report for the last 12 years. This is the fifth to be published by the Reuters Institute.

Acknowledgements

The authors are grateful for the input of 233 digital leaders from 32 countries, who responded to a survey around the key challenges and opportunities in the year ahead.

Respondents included almost 50 editors in chief, almost 40 CEOs or managing directors, and 30 heads of digital and came from some of the world’s leading traditional media companies as well as digital-born organisations (see full breakdown at the end of the report).

Survey input and answers helped guide some of the themes in this report. Many quotes do not carry names or organisations, at the request of those contributors.

As with many predictions reports there is a significant element of speculation, particularly around specifics, and the report should be read bearing this in mind. Having said that, any mistakes – factual or otherwise – should be considered entirely the responsibility of the authors.

Published by the Reuters Institute for the Study of Journalism with the support of the Google News Initiative.

2https://www.theguardian.com/media/2018/nov/05/guardian-passes-1m-mark-in-reader-donations-katharine-viner

8https://reutersinstitute.politics.ox.ac.uk/our-research/how-young-people-consume-news-and-implications-mainstream-media

9 45% in the UK say the news media is often too negative, 39% average of all countries. Digital News Report 2019 – https://www.digitalnewsreport.org/survey/2019/what-do-people-think-about-the-news-media/

10https://reutersinstitute.politics.ox.ac.uk/risj-review/what-can-be-done-digital-media-policy-options-europe-and-beyond

12The Struggle for Talent and Diversity in Modern Newsrooms: A Study on Journalists in Germany, Sweden, and the United Kingdom.

https://reutersinstitute.politics.ox.ac.uk/sites/default/files/2019-07/Talent-and-Diversity-in-the-Media-Report_0.pdf

14https://digiday.com/media/le-monde-debuts-three-podcasts-based-on-stories-that-convert-subscribers/

15 IAB Podcast Ad Revenue Study June 2019 https://www.iab.com/wp-content/uploads/2019/05/Full-Year-2018-IAB-Podcast-Ad-Rev-Study_5.29.19_vFinal.pdf

17https://www.theglobeandmail.com/inside-the-globe/article-new-to-the-globe-listen-to-articles-in-english-french-or-mandarin/

18 Libsyn data for September 2019 shows 58% for Apple, 13% for Spotify (up from 7% a year previously)

19 New Powers, New Responsibilities – a Global Survey of Journalism and Artificial Intelligence, LSE Polis https://blogs.lse.ac.uk/polis/2019/11/18/new-powers-new-responsibilities/