| Statistics | |

| Population | 66m |

| Internet penetration | 84% |

The media in France is characterised by a strong and vibrant broadcasting sector and a weak press that has struggled to manage the transition to digital. There is a growing concentration of media ownership amongst a few powerful tycoons.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| BFM TV | 44% | 18% |

| TF1 news | 41% | 14% |

| France Télévisions news | 35% | 11% |

| M6 news | 26% | 6% |

| I-Télé | 19% | 4% |

| Public radio news | 17% | 6% |

| Commercial radio news | 17% | 5% |

| 20 Minutes | 14% | 3% |

| Regional or local paper | 14% | 3% |

| Canal+ news | 12% | 3% |

| Le Monde | 9% | 2% |

| LCI | 8% | 1% |

| Le Figaro | 8% | 1% |

| Direct Matin | 7% | 1% |

| Ouest France | 6% | 2% |

| Metro | 6% | 1% |

Top Brands % Weekly Usage (ONLINE)

| Weekly reach | Main source | |

|---|---|---|

| 20 Minutes online | 19% | 6% |

| Le Monde online | 18% | 6% |

| Regional/Local paper website | 15% | 5% |

| Le Figaro online | 15% | 4% |

| FranceTVInfo | 15% | 6% |

| BFM TV online | 15% | 6% |

| Huffington Post | 13% | 3% |

| L'Express online | 11% | 1% |

| Le Point online | 11% | 2% |

| Yahoo News | 10% | 4% |

| MSN News | 9% | 4% |

| TF1 news online | 9% | 2% |

| Le Nouvel Observateur | 9% | 1% |

| Linternaute.com | 8% | 1% |

| Libération online | 8% | 1% |

| Médiapart | 8% | 1% |

Overview of key developments

By Alexandre Lechenet

Writer and data-journalist at Libération and former Reuters Institute Journalist Fellow

The Paris attacks in November 2015 and the earlier Charlie Hebdo killings in January, along with two elections, have heightened interest in news over the past year. The 24-hour news channel BFM TV reached 4m viewers on 9 January and 2.5m on the night of 13 November and further cemented its reputation as a core destination for live news. However, it faces new competition from the LCI news channel (part of the TF1 group), which went free to air in April 2016 having previously only attracted small audiences through pay TV.

By contrast, the newspaper sector has been unable to capitalise on the strong interest in the news, despite playing a key role online; a video of the drama outside the Bataclan concert hall taken by a Le Monde journalist on his iPhone was widely shared on social media and the website remains a key online destination. Despite strong online performances by newspaper groups, print circulation keeps falling (-3.83%) and advertising revenues are significantly down (-0.6% in general and -7.9% for newspapers).

Media concentration has been the big story of the last year within the news industry. Patrick Drahi, owner of the telecom provider SFR-Numericable, acquired L’Express-Roularta, and created a new group called Altice Media which includes existing media properties such as left-wing newspaper Libération. Drahi has also taken a significant stake in NextRadioTV, owners of BFM TV and RMC. Meanwhile Bernard Arnault, owner of luxury company LVMH and financial newspaper Les Echos, has bought Le Parisien-Aujourd’hui en France, a daily newspaper for Paris and the surrounding regions, with a sister-version for the rest of France. More than a hundred people left L’Express-Roularta after the ownership change. At Lagardère, owner of magazines and TV channels, around 200 are expected to leave.

Canal+, proprietor of the news channel i-Télé, also has a new owner, Vivendi, whose CEO Vincent Bolloré made significant changes to management as the channel is losing subscribers.

PSB is split between three entities, one for radio, one for TV, and one for international broadcasting. Radio, especially morning news programmes, remains strong. Public service performs well via radio but faces competition from TF1 and other TV news channels. In response, the new leadership at France Télévisions and Radio France are building a joint PSB 24-hour news channel on TV and online. It is due to launch in autumn 2016 and means France will have one of the highest number of free-to-air news channels in the Western world.

In terms of online news, readership of the main websites keeps growing, especially on mobile, but revenue remains a problem. Many publishers operate a metered paywall or use a freemium model – like Le Monde and Le Figaro – restricting some articles to subscribers.

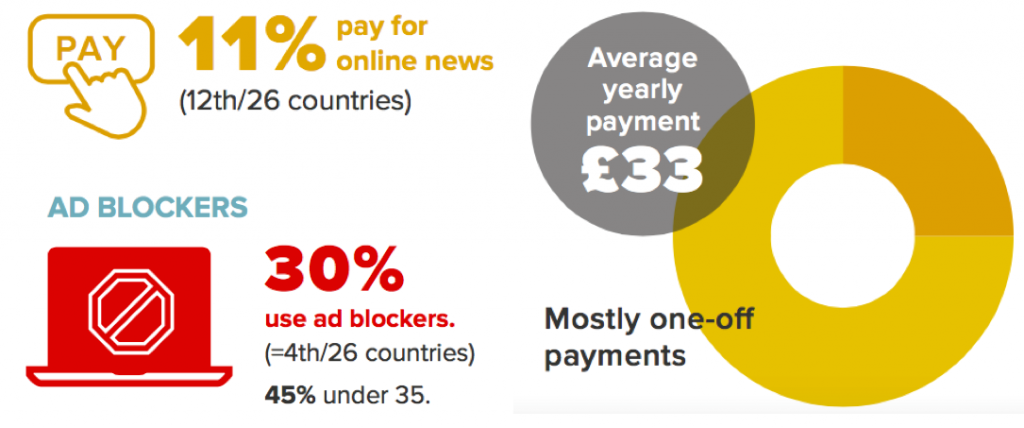

Digital advertising revenues are not rising as fast as expected and have been hit by the growth in ad-blocking, which at 30% is well above the European average. In March 2016, the main publishers launched a coordinated public campaign to increase awareness about the issue and in some cases have restricted access for those using ad-blockers. [24. https://digiday.com/uk/mais-non-french-publishers-find-tougher-tactics-actually-work-ad-block-users/

One exception to the downward industry trends is Mediapart, a profitable news website known for its investigative journalism and strong opinion pieces. Mediapart relies solely on subscription income and the website has no advertising. Les Jours, a start-up founded by former journalists of Libération, launched in March 2016, also with a subscription model. In print, Society, a biweekly magazine, was launched by So Press to critical acclaim. French editions of Huffington Post (13%) and BuzzFeed (4%) are also making an impact – especially with the young.

Changes in media usage 2013–2016

Television news remains the most important source of news in France, although audiences are now dipping especially with the young. Print newspapers have lower reach than elsewhere in Europe.

WEEKLY REACH PER DEVICE

| Computer | Smartphone | Tablet | |

|---|---|---|---|

| 2013 | 53% | 25% | 12% |

| 2014 | 62% | 35% | 18% |

| 2015 | 58% | 37% | 18% |

| 2016 | 57% | 44% | 20% |

SOURCE OF NEWS 2013–16

| TV | Online (inc. social) | Social | ||

|---|---|---|---|---|

| 2013 | 84% | 46% | 68% | 18% |

| 2014 | 82% | 36% | 69% | 26% |

| 2015 | 80% | 27% | 71% | 34% |

| 2016 | 74% | 27% | 71% | 40% |

Paying for news

Most newspaper groups are stepping up efforts to drive digital or bundled subscriptions, but progress is slow.

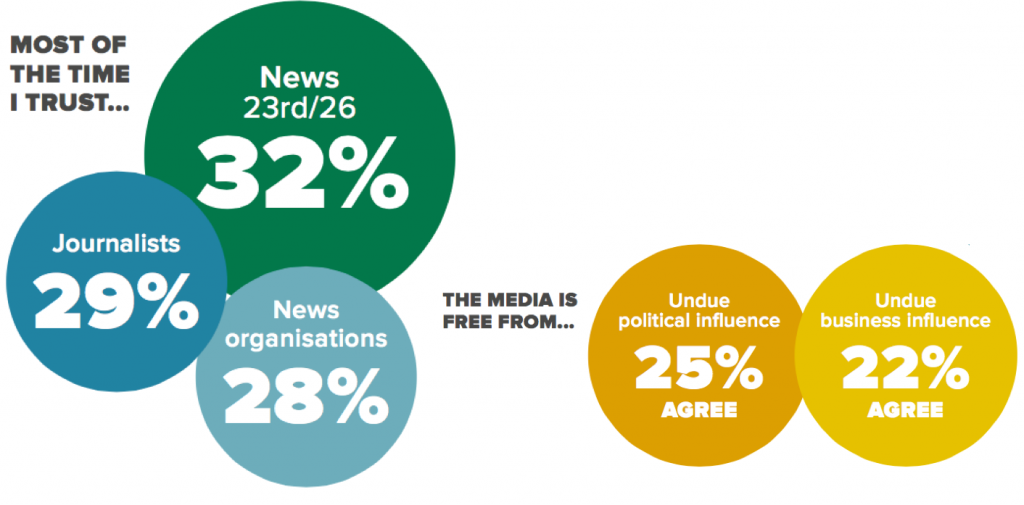

Trust

Overall trust is amongst the lowest in Europe with only around a quarter agreeing that the news is free from political (25%) or commercial (22%) influence. Trust has been affected by a perception that media tycoons known for their links with high profile politicians have interfered directly with editorial matters.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 42% | 51% | |

| 2 | YouTube | 21% | 21% |

| 3 | 8% | 12% | |

| 4 | Google+ | 6% | 3% |

| 5 | 3% | 4% |