| Statistics | |

| Population | 5m |

| Internet penetration | 96% |

The Norwegian media environment mixes strong national commercial and public service media companies with a reputation for digital innovation in content and business models.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| NRK News | 61% | 33% |

| VG | 53% | 9% |

| TV2 News | 53% | 20% |

| Dagbladet | 37% | 1% |

| Aftenposten | 30% | 4% |

| Local or regional paper | 29% | 4% |

| P4 news | 26% | 5% |

| Radio Norge news | 18% | 2% |

| Local radio news | 17% | 1% |

| Dagens Næringsliv | 15% | 1% |

| Local TV news | 13% | 1% |

| Bergens Tidende | 12% | 2% |

| BBC News | 8% | 1% |

| Adresseavisa | 8% | 1% |

| CNN | 7% | 0% |

| Dagsavisen | 6% | 0% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| VG Nett online | 64% | 25% |

| Dagbladet online | 46% | 4% |

| NRK News Online | 45% | 15% |

| TV2 news online | 44% | 10% |

| Aftenposten online | 35% | 7% |

| Nettavisen | 31% | 3% |

| Local/Regional paper websites | 25% | 4% |

| Dagens Næringsliv online | 18% | 1% |

| Bergens Tidende online | 13% | 3% |

| ABCnyheter | 13% | 2% |

| Adresseavisen online | 9% | 2% |

| BBC News online | 8% | 1% |

| Huffington Post | 8% | 0% |

| P4 news online | 7% | 1% |

| Mail Online | 7% | 1% |

| Dagsavisen online | 7% | 0% |

Overview of key developments

By Anders Hofseth

Reuters Institute Journalist Fellow (and NRK)

Online and offline, the market is dominated by the tabloids VG and Dagbladet, the quality title Aftenposten, and two national broadcasters NRK and TV2. Regional and local papers also play a significant role in a country with large distances and strong local identity. Overall, print has been suffering with an ageing readership and falling circulation – down 8.5% in 2015, with tabloids worst affected. Print remains the main source of revenue for media companies, as online growth has stagnated.

Schibsted is the leading publisher in both Norway and neighbouring Sweden – combining multiplatform content creation with a successful classifieds business, which is now active in 21 countries. Despite increasing market dominance online, especially in mobile, powerhouse VG did not meet revenue targets and is cutting costs and staff, for the first time in six years. Norwegian Schibsted media earnings were down 26% in 2015. 1

Another leading publisher, Amedia, which owns 62 local and regional papers, has also suffered reduced revenue, but profits are up 20% following cuts to operating costs and the sale of some titles. In 2016 Amedia was bought by the foundation Sparebankstiftelsen, which has promised to keep the group together.

Norwegians are getting used to paying for online content with widespread bundling of digital access with existing paper subscriptions. The tabloid sector operates a freemium model with 70,000 paying customers for the premium VG+ service and 14,000 for the Dagbladet equivalent (DB+).

Many publishers are cautious about new micropayment services for fear of undermining more lucrative subscriptions, but they have moved into branded and sponsored content in 2015. This has led to concerns around the labelling of sponsored content, with VG criticised twice by the ethical board of Norwegian media.

In digital-born media, Filter Nyheter launched in 2016 with a business model based on sponsored and branded content. In addition to original investigative journalism, this popular newsletter aggregates content from other media and distributes them via Facebook Instant Articles, email, and a WordPress site. Other notable start-ups are Medier24, financed by job listings, and Vio Media, a self-styled ‘Netflix for magazines’.

Meanwhile, the main public broadcaster NRK is facing political and funding pressures, similar to those in other countries. Around 300 jobs have gone over the last two years (about 9% of the total) due to reductions in licence fee income and the Norwegian Parliament is currently considering a new NRK charter. The main issues are related to modernising the TV-based financing model and addressing commercial media’s concerns around NRK’s strong market position (86% daily reach [36. http://www.medienorge.uib.no/statistikk/medium/avis/368 ).

FM radio will be switched off by 2017 and will be replaced by DAB+ and online distribution. This might prove challenging, especially in cars, which today account for a large share of listening. Meanwhile, it’s been a year of podcasting in Norway, with many media houses experimenting with the format, both in-house and by commission.

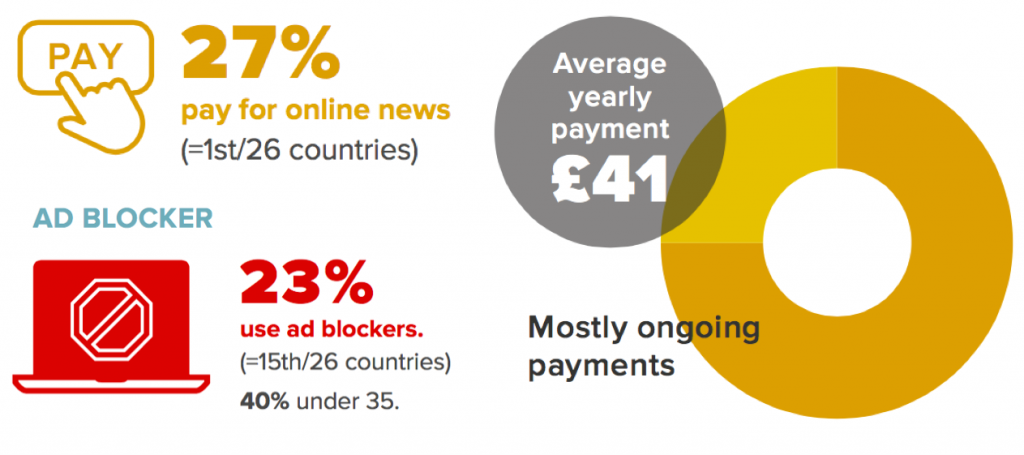

Paying for news

Newspaper readership and subscription has traditionally been high in Norway and this has helped with the transition to online where payment levels are the highest of all our Digital News Report countries.

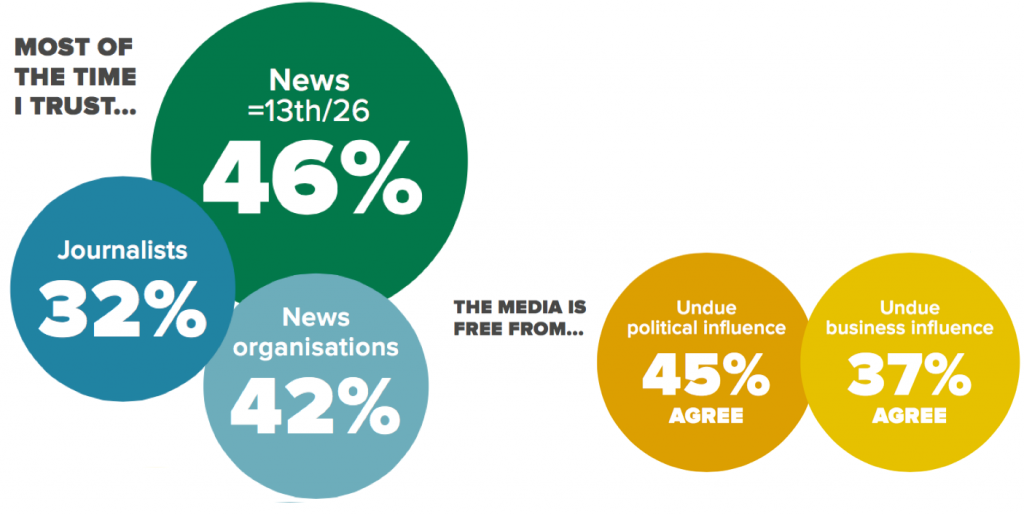

Trust

Norway has average levels of trust with low levels of political polarisation in the media. Trust may have been affected by several factors in 2015: the growth of sponsored content, clickbait tendencies in online media, or the scandal around a journalist systematically plagiarising content.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 45% | 50% | |

| 2 | YouTube | 9% | 10% |

| 3 | 7% | 9% | |

| 4 | 4% | 6% | |

| 5 | Snapchat | 4% | 7% |

- https://journalisten.no/schibsted-media-group-schibsted-rolv-erik-ryssdal/schibsted-varsler-fortsatte-kostnadskutt/300666 More widely, Schibsted has been consolidating and reorganising its media operation with a technology, data, and audience focus, cutting ad sales staff, centralising product development and many non-content functions.

Number two tabloid Dagbladet has also cut staff in the past year, with an announcement in November 2015 that up to 65 further jobs would go. It axed comments below its online articles, saying that the debate had now ‘moved to social media’, and was the first Norwegian publisher to distribute through Facebook Instant Articles.

The issue of digital intermediaries has become a hot topic for publishers, not least because Facebook and Google together now account for around 20% of the entire ad market. [34. https://www.aftenposten.no/kultur/i/JoPP/schibsted-topp-varsler-felles-kamp-mot-facebook-og-google In February 2016, Schibsted Chairman Ole Jacob Sunde called for a new alliance between Norwegian publishers to counter this threat – including collaboration over content, distribution, and sharing of user data. [35. Ibid. ↩