| Statistics | |

| Population | 23m |

| Internet penetration | 93% |

The Australian media environment has endured a period of uncertainty due to ongoing government leadership instability and a looming federal election in 2016.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| Channel 7 News | 41% | 15% |

| Channel 9 News | 39% | 13% |

| ABC News | 38% | 17% |

| Channel TEN News | 28% | 5% |

| SBS News | 21% | 4% |

| A regional or local newspaper | 19% | 2% |

| Herald Sun | 13% | 3% |

| Daily Telegraph | 11% | 2% |

| Sydney Morning Herald | 11% | 2% |

| BBC News | 11% | 2% |

| WIN Television News | 10% | 2% |

| Prime7 News | 10% | 2% |

| Sky News | 9% | 2% |

| Triple J News | 8% | 3% |

| Courier Mail | 8% | 1% |

| The Age | 8% | 1% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| News.com.au | 29% | 10% |

| ABC News online | 29% | 11% |

| Ninemsn | 27% | 12% |

| Yahoo!7 | 21% | 7% |

| Sydney Morning Herald online | 16% | 5% |

| Website of a regional or local newspaper | 15% | 3% |

| BBC News online | 14% | 3% |

| Herald Sun online | 13% | 3% |

| Daily Telegraph online | 12% | 2% |

| Channel TEN News online | 11% | 2% |

| The Age online | 11% | 3% |

| Huffington Post | 10% | 1% |

| Buzzfeed News | 10% | 2% |

| The Australian online | 9% | 1% |

| Sky News online | 9% | 2% |

| CNN online | 8% | 1% |

Overview of key developments

By Caroline Fisher and Jerry Watkins

News & Media Research Centre, University of Canberra

Australia has a high concentration of traditional media ownership dominated by News Corporation and Fairfax Media who together own the majority of national and capital city newspapers. The broadcast landscape features three commercial free-to-air TV networks and two public broadcasters as well as a variety of commercial radio networks and audio streaming services. Under proposed new laws, current ownership restrictions would be lifted allowing mergers and acquisitions and potentially further shrinking the ownership pool.

Smartphone and internet penetration remain high: more than 90% of consumers access the internet at least once a day and 61% use a smartphone or tablet to access online news. With more than 11 million Facebook and 9 million YouTube users, over half of Australians (52%) reported using online and social media as a source of news.

While TV remains the dominant source of news in Australian households, the number of consumers watching free-to-air commercial TV has fallen 15% since 2008, 1 due partly to the growth of subscription on-demand services (SVOD) such as Quickflix, Presto, Stan, and the dominant Netflix, which reached more than 2.7 million homes and attracted more than one million subscribers over the past 12 months. 2 The shift to cheaper SVOD combined with the rising costs

of buying programmes challenges free-to-air services and the dominant pay-TV provider Foxtel.

The radio landscape has been altered by a merger between Macquarie Radio Network and Fairfax Media Limited’s interests. Australians are changing their listening habits, turning to streamed audio providers such as Apple Music – launched in June 2015 – and audio apps such as Spotify and Pandora. Blockbuster podcasts have made an impact but we are yet to see if this will affect everyday news consumption habits. While digital radio take-up in capital cities is strong at 25%, the high cost of rolling out terrestrial digital services to regional and remote areas remains a hurdle. In the short to medium term Australians are likely to continue to consume a mix of analogue, digital, and online streaming audio options.

Newspaper print circulation has continued to fall. Between December 2014 and December 2015 the Sydney Morning Herald (SMH) daily dropped 9% and the Canberra Times a substantial 18.7%. However digital subscriptions for The Herald Sun and The Australian have continued to rise steadily, with a small downturn for the SMH and The Age after rapid earlier increases. 3

Advertising revenue continues to drop for traditional media as investment shifts to online. Newspapers have dropped from 27% to 14% of total ad spend since 2009, whereas online has risen from 17% to 35%. By 2019 internet advertising is expected to reach 50% of total ad spend. 4

News Corp Australia and Fairfax newspapers combined have announced more than 200 editorial staff cuts over the past 12 months. Fairfax is planning to close both the Cooma-Monaro Express and the Summit Sun and reformat the Queanbeyan Age to a weekly, whilst upgrading the online presence of other regional papers. From July 2016 the Canberra Times will become a compact. These changes come on top of Fairfax’s merger of its federal political coverage across its capital city newspapers. Meanwhile BuzzFeed has arrived in the Canberra press gallery with its first dedicated political reporter.

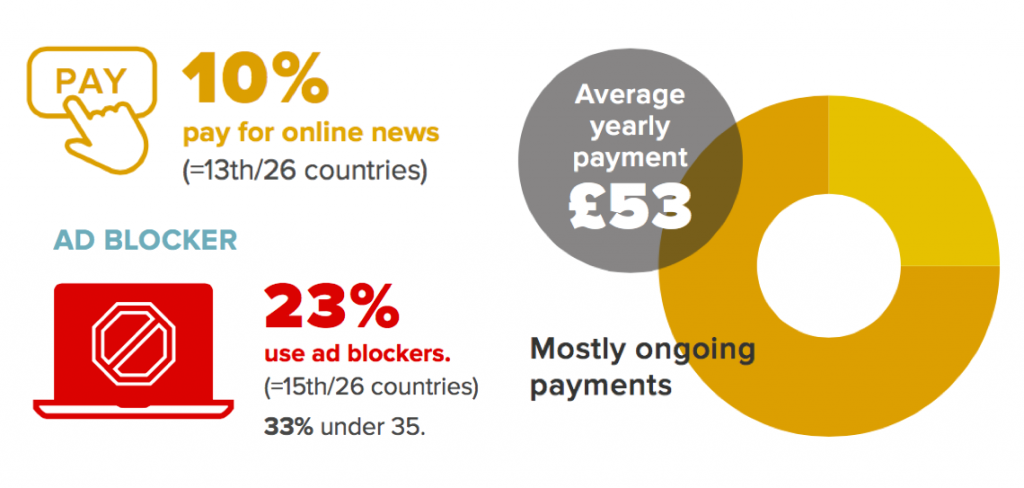

Paying for news

Many Australian publishers operate paywalls but after initial success have struggled to increase the number of digital subscribers beyond loyal users.

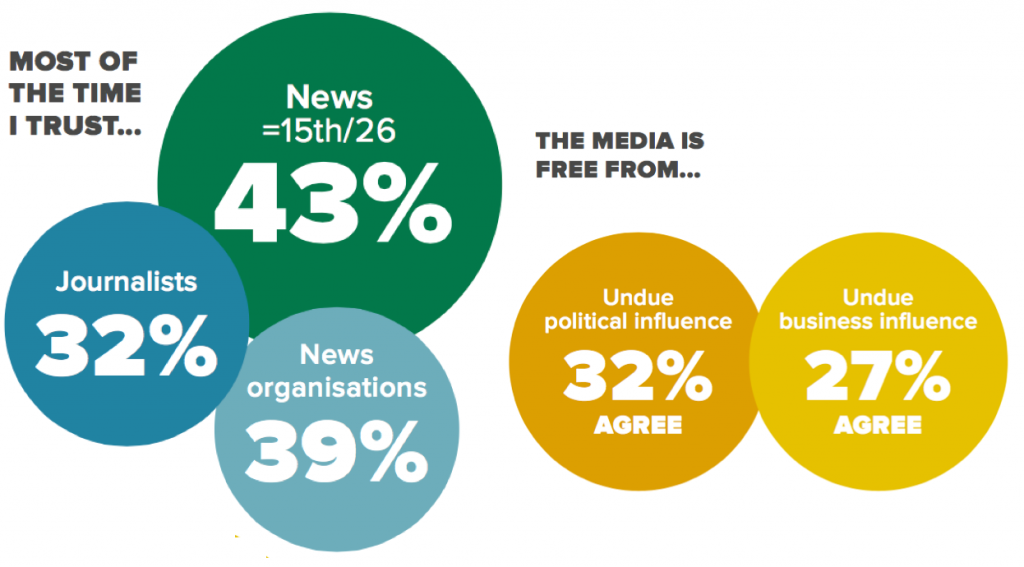

Trust

Australians’ trust in news generally remains quite low compared to other countries, at 43%. While the data indicate that trust in news media has risen over the past 12 months – a shift also seen in the 2016 Edelman Global Trust Survey – trust in social media news sources continues to be lower than in traditional media sources, with TV news remaining the most trusted.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 45% | 53% | |

| 2 | YouTube | 15% | 20% |

| 3 | 8% | 12% | |

| 4 | 4% | 7% | |

| 5 | 3% | 1% |