| Statistics | |

| Population | 5.5m |

| Internet penetration | 96% |

The media environment continues to be characterised by strong public service broadcasters (DR and TV2) and a strong national press, but the presence of public service media online is under increasing pressure from private media and government politicians.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| DR News (inc. P1, P4, etc.) | 71% | 30% |

| TV2 News (inc. regional news) | 64% | 36% |

| Local free weekly newspaper | 21% | 1% |

| Metroxpres | 16% | 2% |

| Søndagsavisen | 14% | 1% |

| Local or regional newspaper | 14% | 2% |

| Radio 24syv news | 10% | 2% |

| Commercial radio news | 9% | 2% |

| Politiken | 9% | 3% |

| BT | 9% | 1% |

| Jyllandsposten | 8% | 2% |

| Berlingske | 8% | 2% |

| Ekstrabladet | 8% | 1% |

| Børsen | 5% | 1% |

| Fagblade | 5% | 0% |

| BBC News | 4% | 1% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| DR News online | 49% | 16% |

| TV2 news online | 44% | 19% |

| EkstraBladet online | 32% | 10% |

| BT online | 27% | 4% |

| Politiken online | 23% | 6% |

| Jyllandsposten online | 19% | 5% |

| Free local weekly paper website | 18% | 3% |

| Berlingske online | 18% | 4% |

| Local or regional paper website | 15% | 1% |

| Børsen online | 11% | 1% |

| Metroxpress | 10% | 2% |

| Information.dk | 9% | 1% |

| Dagens.dk | 9% | 1% |

| Avisen.dk | 8% | 1% |

| Radio24syv news online | 8% | 2% |

| Sondagsavisen online | 7% | 0% |

Overview of key findings

By Kim Christian Schrøder and Mark Ørsten

Roskilde University

In the newspaper sector, industry readership figures indicate that the steady decline in printed newspaper sales stabilised in 2015, however average figures conceal significant differences between titles that have seen readership growth and those titles that continue to decline.

The acquisition of Denmark’s oldest newspaper group Berlingske by the Belgian De Persgroep resulted in substantial staff layoffs, the selling of its local and regional newspapers, and a ‘superbrand’ strategy concentrating on the three national titles Berlingske (quality), BT (tabloid), and Weekendavisen (weekly niche paper). Another consequence was the closing of the Berlingske news agency, leaving Ritzau as the sole Danish operator with this function.

The flipside of Berlingske’s sell-off has been the substantial growth of the regional-local conglomerate Jysk Fynske Medier, which has become a strong, and in many places the sole, actor in provincial Denmark, as well as being the nation’s second largest newspaper operator after JP/Politiken.

Thanks to the reformed media subsidy scheme, a number of new digital-born players have emerged on the newspaper scene, with Zetland and Føljeton as the most ambitious and innovative attempts to rejuvenate online journalism through background and in-depth coverage from non-conventional angles of a handful of selected issues every day. The coming year will see a testing of the sustainability of their no-advertising, subscription-based business models.

Older Danish digital-born news providers (dagens.dk, avisen.dk, altinget.dk) seem to have consolidated their role in the media scene through continued but modest growth in readership. International digital-born players like BuzzFeed and the Huffington Post hardly register in Danish readership surveys.

Public service as well as private news producers (with the exception of metroxpress) remain sceptical that the advantages of embracing the news initiatives of global operators like Facebook Instant Articles and Apple News will eventually outweigh the disadvantages of giving up distribution control over their news products.

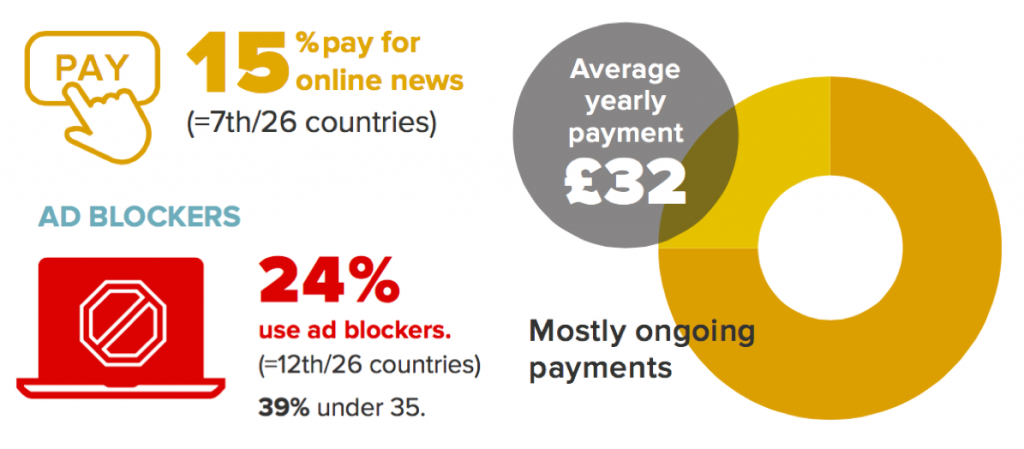

As the willingness to pay for online news grows only incrementally, there has been increasing concern about the rapid take-up of ad-blocker software (now used by 24%) and its adverse effects on news producers’ business models. One counter measure from news providers has been the development of advertorial content strategies by some newspapers, amidst warnings that this may in the long run jeopardise news credibility among readers.

The use of social media for news continues to soar, with other social media operators dwarfed by Facebook as the unrivalled market leader in Denmark.

PSB news providers continue to lose audiences for their offline products – TV more so than radio – but still attract more than half the population on a weekly basis, and almost two-fifths consider them jointly as their main offline news brand. This decrease is more than counter-balanced by the growth in users online, where private newspapers’ fears of being outcompeted have led to repeated calls for politicians to curb the online services of public service media, especially licence-financed DR. The change of government from a centre-left coalition to a centre-right one in 2015 brought politicians to power who are more responsive to the arguments of private interests, making future regulation, or self-regulation, of DR’s news services a not unlikely scenario.

The newcomer (2012) public service talk radio channel 24syv has now attained its goal of reaching half a million listeners per week, perhaps reflecting the general increase in radio listening after years of slow decline.

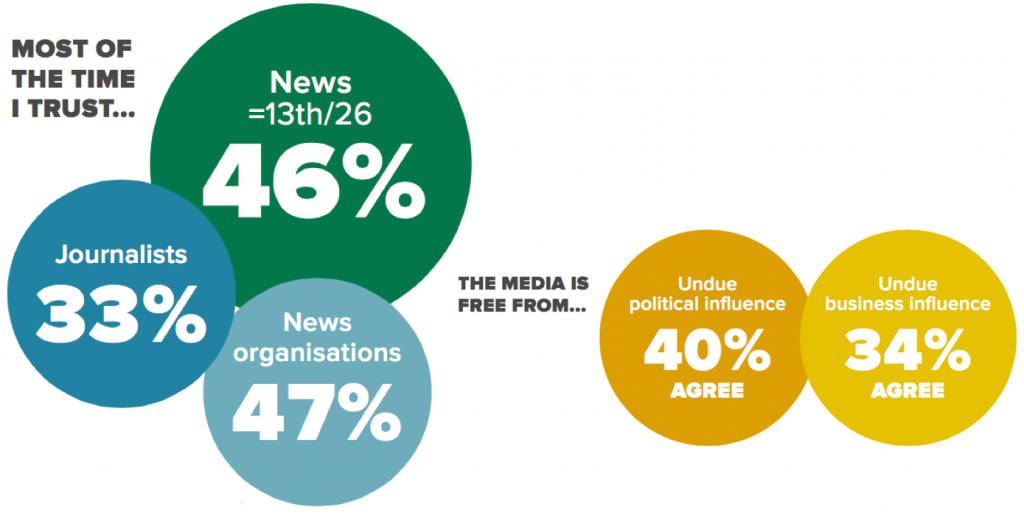

The Danes’ belief in the relative political and commercial independence of their news media may owe its existence to the fact that, alongside prominent arm’s length-based public service media, most Danish newspapers are run by not-for-profit foundations.

Changes in media usage 2013–2016

Denmark has adopted smartphones and tablets faster than in many other countries with online overall now ahead of TV news. Print newspapers sell fewer copies than elsewhere in the Nordic region.

WEEKLY REACH PER DEVICE

| Computer | Smartphone | Tablet | |

|---|---|---|---|

| 2013 | 58% | 44% | 26% |

| 2014 | 68% | 52% | 34% |

| 2015 | 67% | 57% | 39% |

| 2016 | 63% | 60% | 37% |

SOURCE OF NEWS 2013–16

| TV | Online (inc. social) | Social | ||

|---|---|---|---|---|

| 2013 | 85% | 49% | 81% | 31% |

| 2014 | 80% | 42% | 83% | 39% |

| 2015 | 75% | 34% | 85% | 47% |

| 2016 | 73% | 29% | 84% | 56% |

Paying for news

Danish newspaper groups, which compete online with free content from strong broadcast players, use a pragmatic mix of soft paywalls and premium content models to drive revenue.

Trust

The low level of trust in journalists may be due to a number of recent highly publicised scandals. For example, a sports journalist was recently revealed to have produced hundreds of fake news reports for a national tabloid and several magazines, and several journalists have been accused of plagiarising news from international media sources.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 43% | 48% | |

| 2 | YouTube | 7% | 10% |

| 3 | 5% | 3% | |

| 4 | 4% | 5% | |

| 5 | 2% | 4% |