| Statistics | |

| Population | 4.5m |

| Internet penetration | 83% |

Irish titles have increased their reach with revenue streams stabilising, while digital news is on the rise with increasing numbers consuming on their mobile phones.

Top Brands % Weekly Usage

TV, Radio and Print

| Weekly use | Main source | |

|---|---|---|

| RTE News | 59% | 33% |

| Sky News | 32% | 8% |

| BBC News | 30% | 6% |

| Irish Independent/Herald | 25% | 5% |

| TV3 News | 24% | 2% |

| Local Radio News | 21% | 5% |

| Irish Times | 21% | 5% |

| Today FM news | 20% | 6% |

| Newstalk | 20% | 5% |

| Sunday Independent | 16% | 1% |

| Regional or local paper | 14% | 1% |

| UTV Ireland/NI news | 13% | 1% |

| ITV or Channel 4 News | 11% | 1% |

| The Sunday Times | 10% | 1% |

| CNN | 8% | 1% |

| Irish Daily Mail | 8% | 1% |

Top Brands % Weekly Usage

Online

| Weekly use | Main source | |

|---|---|---|

| RTE News online | 42% | 15% |

| Irish Independent/Herald online | 36% | 11% |

| Journal.ie | 34% | 11% |

| Irish Times online | 29% | 6% |

| BreakingNews.ie | 24% | 5% |

| BBC News online | 22% | 5% |

| Sky News online | 19% | 5% |

| Her.ie/joe.ie | 16% | 3% |

| Local radio news online | 15% | 3% |

| Yahoo News | 14% | 4% |

| Irish Examiner online | 13% | 2% |

| MSN News | 11% | 3% |

| Mail Online | 11% | 2% |

| Huffington Post | 11% | 1% |

| Local/Regional paper website | 10% | 1% |

| Guardian online | 10% | 2% |

Overview of key developments

By Jane Suiter and Niamh Kirk

Dublin City University

There have been a number of changes in the corporate structure of leading Irish news organisations over the last year. Independent News & Media (INM) sold its interests in Australia, clearing debts and increasing reserves. It also bought four magazines in Northern Ireland while announcing the closure of its Belfast printing press in June 2016 due to the continued decline in print sales as well as the end of the contract. INM titles such as the Irish Independent, the Herald, the Sunday World, Sunday Life, and the Belfast Telegraph all utilised the press.

UTV Ireland, along with UTV NI, was acquired by the UK’s largest commercial network, ITV, for €135m in February 2016, along with other entities such as radio station talkSPORT, digital operations Tibus (digital infrastructure), and Simply Zesty (digital marketing).

More telecoms operators moved into broadcast: Virgin Media’s parent group Liberty Mobile acquired TV3 in a €87m deal which also saw UPC rebrand to Virgin Media Ireland. Eir (formerly Eircom) bought Irish satellite channel Setanta Sports.

There was also expansion by Irish companies into the UK. Communicorp invested in the British market with acquisitions of eight radio stations from the Global Radio Group. Irish digital-born publishers Maximum Media, which operate entertainment sites joe.ie and her.ie, expanded into the UK with offices in Manchester and London.

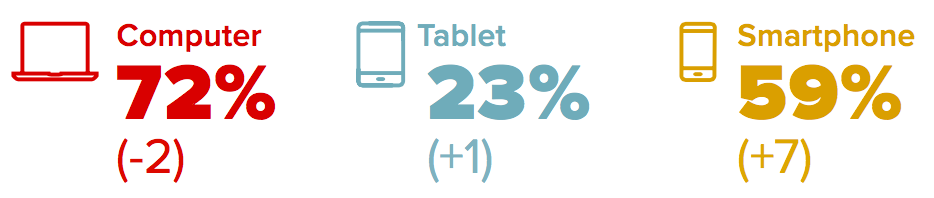

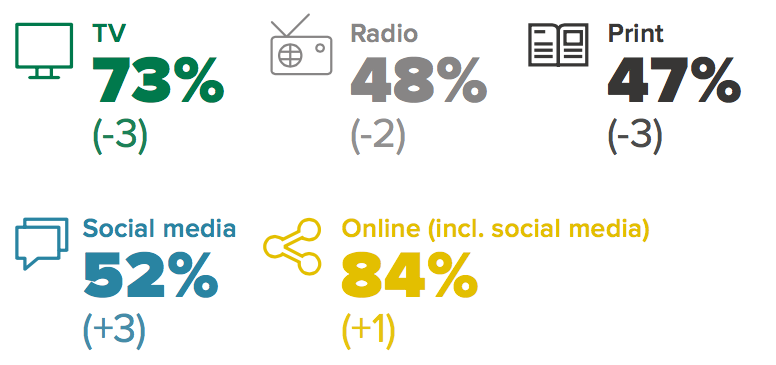

The reach of most legacy brands fell in their traditional operations, however UTV Ireland bucked the negative trend with a 2% increase. While the reach of public service broadcaster RTE fell (-7) in TV news and (-3) in radio, it increased digital reach by (+11). RTE is three years into the five-year strategy and has continued to push developments across multiple platforms and devices, with its app accounting for about 40% of its digital traffic (RTE Annual Report 2014). Ireland has one of the highest penetrations of smartphones in the world, the highest in Europe (Statcounter) fuelled in part by adoption by younger demographics.

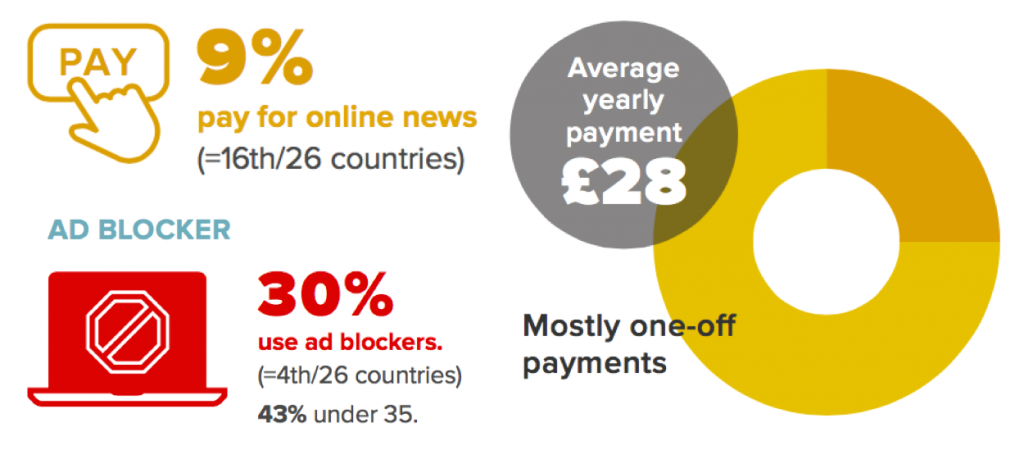

Free news continues to create a climate averse to digital subscriptions. The top three online news brands are the public service broadcaster, RTE, digital-born thejournal.ie, and the independent online which all offer news that is free to consumers. Despite this, some publishers have been experimenting with paid content. The Irish Times metered paywall has been in operation for just over one year and still reported an increase in overall traffic (Joint National Readership Survey, JNRS). The Irish Sun, which is behind a full paywall, also saw an increase in digital readership and Times Newspapers UK expanded its digital operations in Ireland with the Sunday Times adding a daily paid-for edition.

The high level of free advertiser-subsidised digital news in Ireland has had a multifaceted impact. Some 30% use ad-blockers to protect against unwanted commercial intrusions, one of the highest levels in Europe. Despite this, the level of digital advertising across the 16 NewsBrands Ireland titles (NBI, formerly National Newspapers Ireland, digital and print titles) is growing steadily. Between January and September 2015 revenue from advertising was up 3.75% on the same period last year (NBI Data Centre).

Paying for news

Wide availability of free news – including from UK brands – has made Irish readers reluctant to pay for online news. The introduction of some soft paywalls and premium content means the headline rate is edging higher.

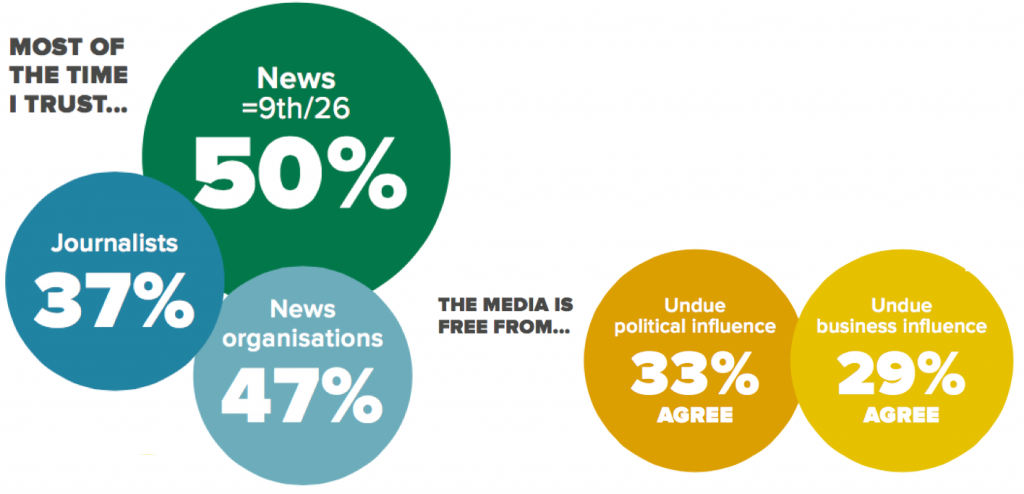

Trust

This is an election year, with increased coverage adding to public scrutiny of the media through social media. Other issues that may have directly impacted on public trust include injunctions by media owners against the press, which failed to suppress public record documents. There were also legal disputes with the government and individual politicians, and revelations of journalists’ phones and records being spied on by police.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 45% | 56% | |

| 2 | YouTube | 17% | 17% |

| 3 | 13% | 15% | |

| 4 | 7% | 12% | |

| 5 | 4% | 4% |