| Statistics | |

| Population | 10m |

| Internet penetration | 68% |

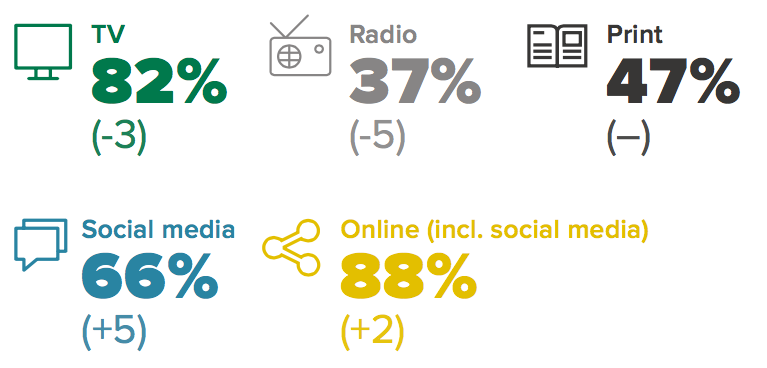

The news media environment in Portugal is characterised by a high reliance on television news sources, a weakening print media sector and a radio sector that struggles to remain relevant. We also see a focus on television-centred business strategies and a decreasing number of journalists in newsrooms.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| SIC News | 72% | 32% |

| TVI News | 62% | 20% |

| RTP/RDP News | 44% | 15% |

| Jornal de Notícias | 27% | 6% |

| Correio da Manhã | 25% | 4% |

| TSF | 20% | 4% |

| Público | 18% | 2% |

| Expresso | 17% | 2% |

| Diário de Notícias | 14% | 1% |

| Regional or local paper | 13% | 1% |

| Rádio Renascença | 13% | 2% |

| A Bola | 12% | 1% |

| Euronews | 11% | 0% |

| Correio da Manhã TV | 11% | 2% |

| Record | 10% | 1% |

| O Jogo | 9% | 0% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| SIC News online | 46% | 6% |

| TVI News online | 38% | 7% |

| Sapo News | 36% | 14% |

| Notícias ao Minuto | 34% | 12% |

| Jornal de Notícias online | 34% | 8% |

| Público online | 31% | 5% |

| Correio da Manhã online | 31% | 7% |

| Expresso online | 25% | 3% |

| Diário de Notícias online | 24% | 2% |

| RTP/RDP News online | 19% | 2% |

| Observador online | 18% | 4% |

| A Bola online | 17% | 2% |

| MSN News | 16% | 5% |

| Diário Económico online | 15% | 1% |

| Jornal de Negócios online | 15% | 1% |

| Record online | 14% | 1% |

Overview of key developments

By Gustavo Cardoso and Ana Pinto Martinho

ISCTE University Institute of Lisbon

In television, private broadcasters SIC and TVI are the dominant brands, either through their TV channels or news channels (‘SIC Notícias’, the first 24/7 news channel launched in Portugal, and ‘TVI 24’). The Portuguese public broadcaster, RTP, is also an important player offering two channels and a dedicated news one (‘RTP 3’, former ‘RTP Informação’) – following a successful rebranding with improved audience figures.

In terms of print news, Jornal de Notícias and Correio da Manhã confirm their status as key reference brands. The latter, a popular tabloid paper, has entered the television business with a successful new cable TV news offer Correio da Manhã TV. Other traditional print media outlets such as Económico,that abandoned its print edition in early 2016, and A Bola (a sports newspaper) have also invested in TV channels, which are seen as a more lucrative investment than either print or online.

The news market in Portugal has been unable – despite a recovery in advertising revenues – to counter the decrease in other revenues obtained through premium telephone numbers in television contests, loss of paid subscriptions, and falling revenues in renewal of cable TV distribution licences. Also of importance for the financial health of the Portuguese media sector is its exposure to debt and low stock market values.

As for radio broadcasters, TSF, Rádio Renascença (private) and Antena 1 (public broadcaster) play a significant role in the news landscape. While other radio stations in Portugal also provide news, these three brands combine music and news – an approach that seems to work well in the Portuguese market both in terms of advertising revenues and audiences.

Five media groups dominate the news in Portugal. Besides the public TV and radio broadcaster RTP, groups such as COFINA (Correio da Manhã – TV and newspaper, Negócios newspaper), Global Media (Jornal de Notícias, DN – newspapers and TSF – radio), IMPRESA (Expresso – newspaper and SIC – TV channels), and PRISA (TVI – several TV channels) provide the majority of news production in Portugal, both offline and online.

Portugal has seen a reduction in numbers of 1,218 journalists between 2007 and early 2015. The media industry now employs just 5,621 journalists – an all time low. Unemployment and the widespread use of trainees in newsrooms are two emerging trends for 2016.

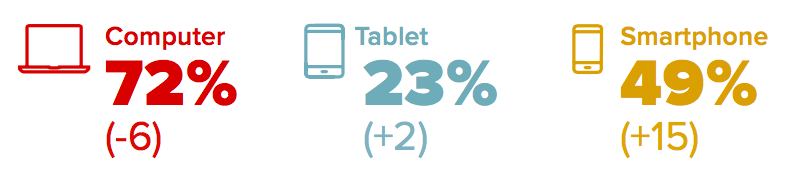

The past year has seen a significant rise in smartphone use for news (+15), as well as a strong increase in social media for news.

This year’s data show a media environment characterised by the offline dominance of private television channels (SIC and TVI) and online by television brands (SIC), telecom brands (SAPO), an internet-only brand (Noticias ao minuto) and in the next three places newspapers (, Público, and Correio da Manhã.

The online media brands show the distinctive nature of the Portuguese market. Two of the top five spots go to SAPO, owned by major Portuguese telecom carrier (PT). SAPO hosts some media outlets such as online SIC Notícias (the cable news TV channel) and the online versions of several newspapers and magazines, and it also publishes original content of its own through the Sapo.pt portal. In fourth place we find another news aggregator, ‘noticiasaominuto.com’ that offers edited contents from other news outlets.

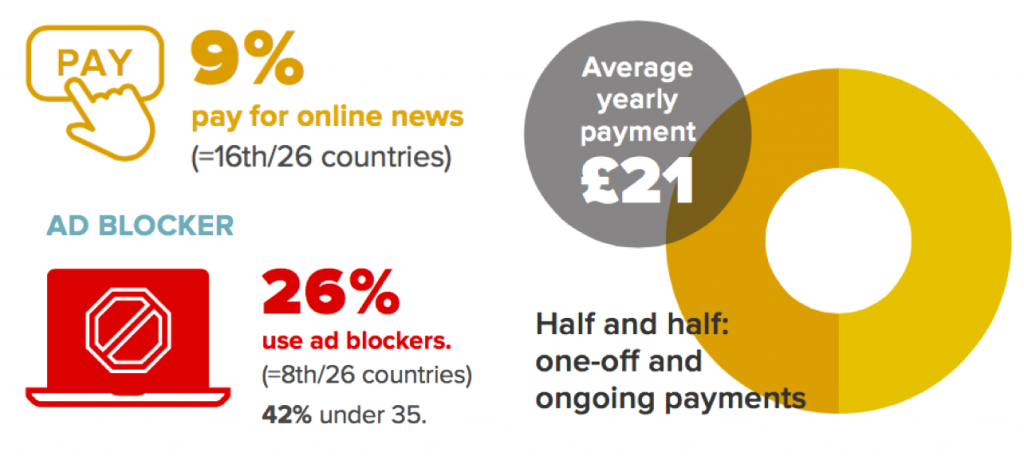

Paying for news

Payment for online news in Portugal remains low (9%), with slow growth

in digital and bundled subscriptions.

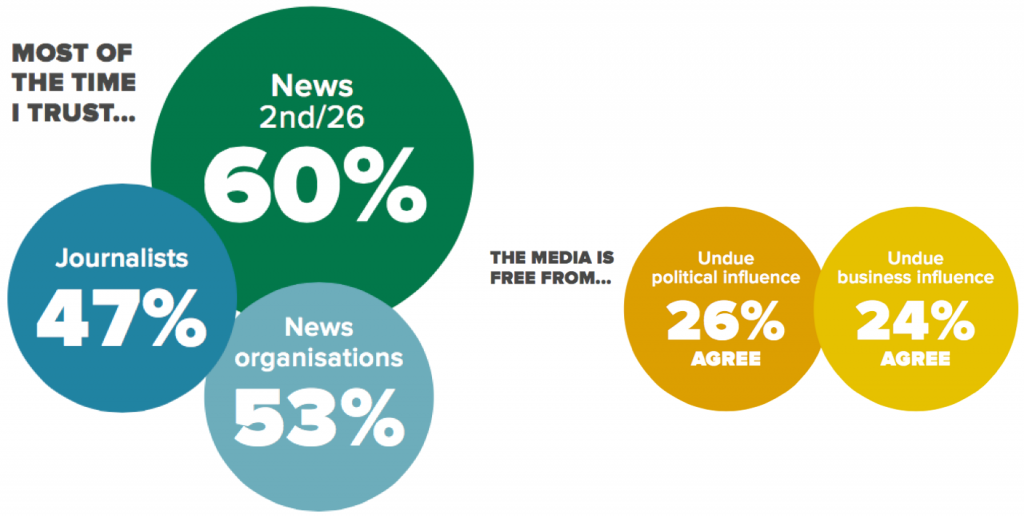

Trust

These data confirm other studies showing high levels of trust in the news and journalists in Portugal. 1 This may relate to a strong tradition of press freedom, which is guaranteed under the constitution following the 1974 revolution. This round of data is particularly relevant as 2015 was marked by several important political changes in the Portuguese Parliament and Republic Presidency.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 63% | 65% | |

| 2 | YouTube | 17% | 16% |

| 3 | Google+ | 7% | 3% |

| 4 | 6% | 5% | |

| 5 | 5% | 5% |

- A Sociedade em Rede em Portugal’, CIES-IUL/Fundação Calouste Gulbenkian. ↩