| Statistics | |

| Population | 65m |

| Internet penetration | 92% |

The media environment is characterised by a strong public broadcaster (the BBC) and by a vigorous and highly competitive national press – including a strong tabloid sector.

Top Brands % Weekly Usage (TV, Radio and Print)

| Weekly use | Main source | |

|---|---|---|

| BBC News | 66% | 44% |

| ITV News | 31% | 8% |

| Sky News | 22% | 7% |

| The Sun (and Sunday) | 14% | 4% |

| Daily Mail (and Sunday) | 13% | 4% |

| Daily Mirror (and Sunday) | 11% | 4% |

| Regional or local newspaper | 11% | 1% |

| Metro | 11% | 2% |

| Channel 4 News | 9% | 1% |

| Commercial radio news | 9% | 2% |

| The Times/Sunday Times | 7% | 2% |

| Daily Telegraph (and Sunday) | 6% | 2% |

| London Evening Standard | 5% | 1% |

| The Guardian/Observer | 4% | 1% |

| Channel 5 News | 4% | 0% |

| ‘i’ | 3% | 1% |

Top Brands % Weekly Usage (Online)

| Weekly use | Main source | |

|---|---|---|

| BBC News online | 51% | 36% |

| Mail Online | 17% | 7% |

| Huffington Post | 14% | 2% |

| The Guardian online | 14% | 4% |

| Sky News online | 11% | 5% |

| Website of a local paper | 11% | 2% |

| Buzzfeed News | 9% | 1% |

| The Telegraph online | 9% | 2% |

| The Mirror online | 8% | 2% |

| MSN News | 8% | 3% |

| Yahoo News | 7% | 3% |

| The Independent/i100 online | 6% | 0% |

| ITV News online | 5% | 1% |

| The Sun online | 5% | 1% |

| The Lad Bible | 4% | 0% |

| The Times online | 2% | 0% |

Overview of key developments

by Nic Newman

Research Associate, Reuters Institute for the Study of Journalism

Over the last year the newspaper sector has been hit hard by a sharp fall in print advertising, by the growth of ad-blockers, and by problems of monetising content on mobile devices.

The Guardian, which recently expanded operations to the US and Australia, increased operating losses to almost £50m in the year to March and has announced plans to cut 20% of its cost base. The 30-year-old Independent became the first UK national newspaper to stop the presses and go ‘online only’, with the loss of around 75 jobs. Meanwhile, Mail Online, which claims to be the world’s most visited English-language website, missed revenue targets by £7m and remains loss-making.1

Trinity Mirror closed digital spin-offs and consolidated its position in regional news by acquiring rival publisher Local World. Johnston Press, owner of The Scotsman along with more than 200 regional titles, bought the profitable ‘i’ newspaper from the Independent for £24m but suffered sharp falls in print circulation and advertising in its core business and is reported to be considering selling newspapers to pay off heavy debts. It has laid off hundreds of journalists since 2009.2

By contrast, the fortunes of some news organisations that have been relying on paid content are looking up. A new access model based on paid online trials helped the Financial Times grow 8% to 780,000 paid subscribers, of whom 566,000 subscribe to a digital platform. In July 2015, the FT was sold to Nikkei, Japan’s largest media company for £844m.

The Times returned to profit for the first time since 2002 (£21m operating profit in the year to June 2015) and has attracted around 150,000 paid digital subscriptions (-6%).3 Growing or even maintaining this base is proving a challenging process and The Times has started publishing limited free content in Apple News and a cheaper international app to try to attract new customers. Meanwhile the mass-market Sun newspaper, also owned by Rupert Murdoch’s News UK, abandoned its online paywall experiment in November after too few people (around 200,000) signed up for its £7.99 a month subscription.

The BBC has faced a difficult year following pressure from print publishers over its size and scope and a quick-fix deal with the government to pay for free licence fees for the over-75s from within a fixed income, amounting to a considerable cut in funding for its services. Its news division is implementing cuts of £5m, with the likelihood of that increasing to £80m over the next four years. 4

Despite this, the BBC remains one of Europe’s most successful public broadcasters (PSBs) with impressive weekly reach online (51%) and via TV and radio (66%). Most of the BBC’s online users (70%) also say BBC News is their main source of online news, dwarfing other providers. The BBC is experimenting with short form and social video formats and publishing content via Apple News and Facebook’s Instant Articles.

Digital-born media brands are beginning to make more impact in the UK. BuzzFeed UK (+5) has expanded its news operation, poaching Janine Gibson and other key staff from the Guardian. Its investigative team broke a major story around match fixing in tennis, in a historic partnership with the BBC. The Huffington Post (+2) continues to build audiences in the UK and now beats all newspapers apart from the Mail and the Guardian in terms of online reach. Lad Bible (4%) is a new entrant in digital news with a light-hearted content mix aimed at young men.

Changes in media usage 2013–2016

Smartphone news use has risen to a record 46% with many publishers reporting the majority of traffic from mobile devices. By contrast tablet news usage is moving in the other direction.

WEEKLY REACH PER DEVICE

| Computer | Smartphone | Tablet | |

|---|---|---|---|

| 2013 | 67% | 29% | 16% |

| 2014 | 56% | 33% | 23% |

| 2015 | 59% | 42% | 31% |

| 2016 | 55% | 46% | 29% |

SOURCE OF NEWS 2013–16

| TV | Online (inc. social) | Social | ||

|---|---|---|---|---|

| 2013 | 79% | 59% | 74% | 20% |

| 2014 | 77% | 49% | 73% | 28% |

| 2015 | 75% | 39% | 73% | 36% |

| 2016 | 70% | 35% | 72% | 35% |

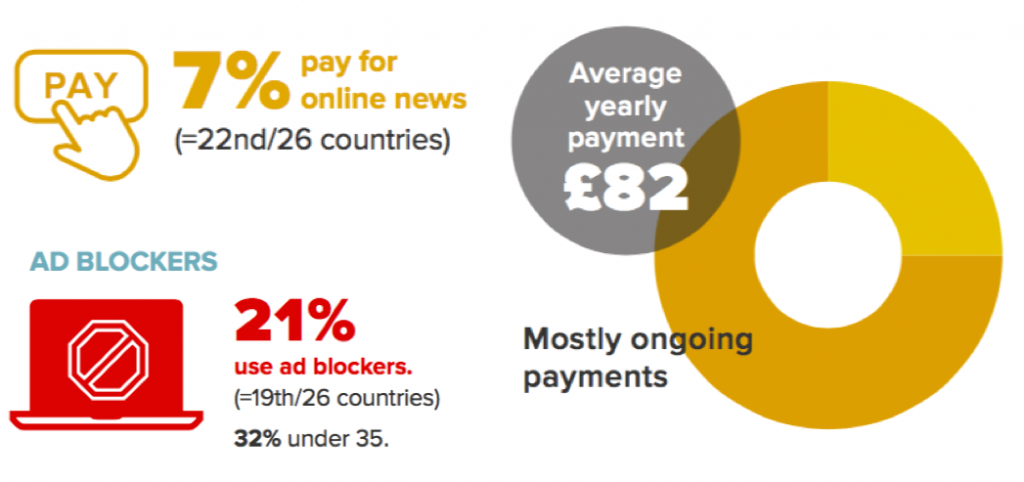

Paying for news

The UK has one of the lowest headline payment rates of all our countries but most of these represent high value ongoing subscriptions. More publishers are investigating paid content or membership models.

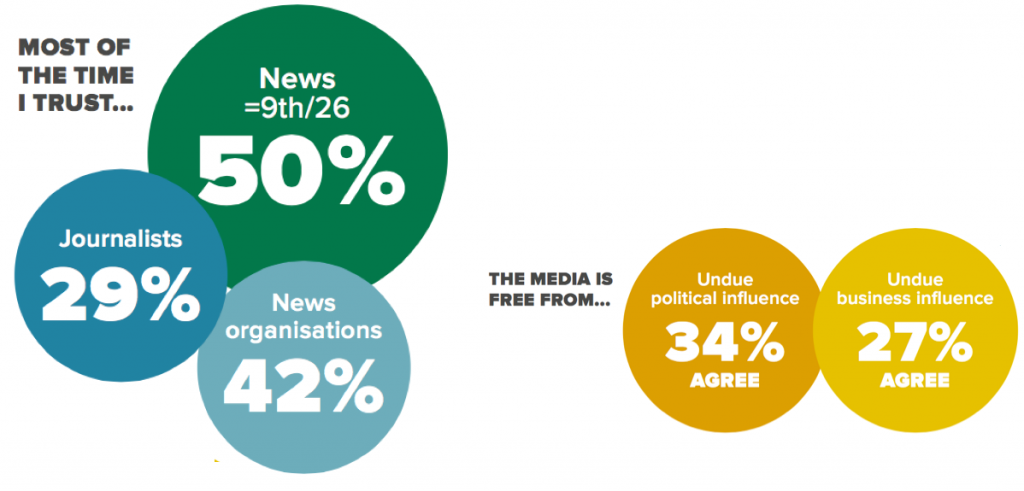

Trust

News brands have a strong heritage and reasonable levels of trust, but the reputation of journalists has been affected by recent scandals involving phone hacking and other invasions of privacy by parts of the tabloid press. In polls television journalists (who are required by UK regulator Ofcom to present unbiased news) are considered more trustworthy than print journalists.

Scroll data area to see more

TOP SOCIAL NETWORKS*

| RANK | NETWORK | ALL | U35s |

|---|---|---|---|

| 1 | 28% | 41% | |

| 2 | 12% | 20% | |

| 3 | YouTube | 7% | 11% |

| 4 | 3% | 5% | |

| 5 | 2% | 3% |

- http://www.ft.com/cms/s/0/a5ded58e-bbab-11e5-b151-8e15c9a029fb.html#axzz3zUAMUtvM ↩

- http://www.telegraph.co.uk/finance/newsbysector/mediatechnologyandtelecoms/media/12107727/Johnston-Press-seeks-to-offload-struggling-local-newspapers.html ↩

- http://www.ft.com/cms/s/0/ff5679dc-f0f8-11e5-9f20-c3a047354386.html#axzz46CK3VGEZ ↩

- http://www.theguardian.com/media/2016/feb/29/bbc-news-cuts-news-channel ↩