| Statistics | |

| Population | 5.5m |

| Internet penetration | 92% |

Esa Reunanen

University of Tampere, Finland

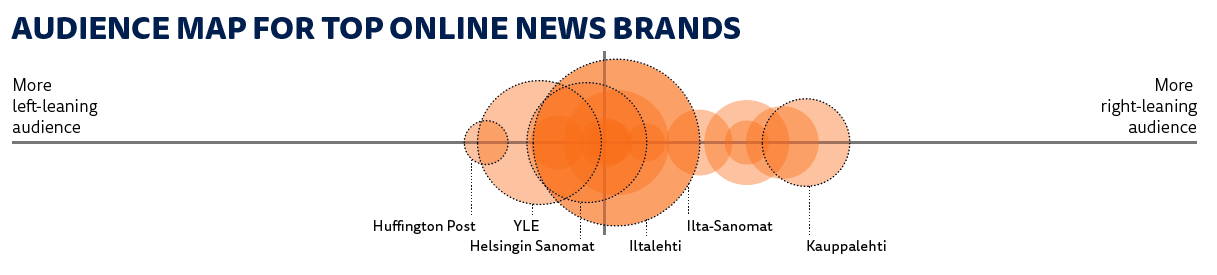

The media environment is characterised by a strong regional press and public broadcaster (YLE), one important national daily (Helsingin Sanomat), and two popular evening tabloids, both reaching half of the population online.

Traditional Finnish media companies have maintained their strong and trusted audience position offline and online. The Finnish language and small market seem to shield national news brands somewhat against international competition while homegrown pure players have made little impact. Other reasons for the popularity of traditional Finnish media companies online are the amount of free content still available (especially the evening tabloids and YLE) combined with soft paywalls, bundled subscriptions, and the strong Finnish reading tradition.

The print circulations of newspapers have continued their decline in 2016. This is a serious problem for newspaper companies, because most of their revenue still comes from print. The biggest daily newspaper, Helsingin Sanomat lost 5.6% of its print circulation, and the second biggest daily, Aamulehti, lost 1.8% (source: Media Audit Finland). However, the overall situation in Finnish media business – not necessarily the news business, though – seems to have turned more positive. The total media advertising spend in 2016 grew slightly (0.9%) – with online advertising up 12.6% (source: Kantar TNS), and turnover of the biggest Finnish media companies has also increased with Sanoma Media Finland reporting a growth of 1.4% (2015: ‑10.1%) and Alma Media 21.2% (2015: ‑1.3%). In 2016, Alma strengthened its online portfolio by buying a popular news and blog site Uusisuomi.fi (9% weekly reach). Keskisuomalainen, which has a strong position in newspaper publishing in central Finland, continued its growth strategy by acquiring ESS, a family-owned publisher of a regional newspaper in Lahti.

In contrast to the positive news from the advertising market, willingness to pay for digital news has not grown in Finland during the last few years – although the proportion paying (14%) is still higher than in many other countries. This may be connected to Finnish newspaper publishers’ strategy of easing their print-readers’ way into digital by offering bundled subscriptions at a similar price, or just a little higher, to print-only offers. This strategy has made bundled subscriptions quite popular in Finland, although room for further growth may be limited. Only 6% of those who do not pay for digital news say they are likely to pay in the next year. This somewhat bleak outlook has encouraged Finnish media companies to find business in new areas, making use of their user data and marketing skills. Transaction and marketplace websites such as cars, homes, and recruitment have become a much more important part of media companies’ business portfolios.

The media industry in Finland is waiting for the government’s decision to reduce the 24% VAT for digital media to the same level as print subscriptions (10%) from the beginning of 2018, subject to an EU decision to let member states decide their VAT level.

The discussion about YLE’s position and its impact on private news media continued in 2016. The proposal from a parliamentary working group that YLE should support the Finnish News Agency (STT) by starting to use its services has now been implemented. Towards the end of 2016, YLE was accused of compromising its journalistic integrity by suppressing critical reporting of politicians including the Prime Minister. The leadership of YLE refuted the accusations and ordered an independent audit of journalistic decision-making within the organisation. The audit found signs of compromised journalistic integrity and suggested that YLE improves its processes to protect its independence.

The most famous fake or alt-news site in Finland is MV-lehti, which is now under police investigation. The site offers news with a heavy anti-immigration, anti-Islam, and anti-legacy media slant, copying and modifying material from others. This site, and others like it, seeks to erode trust in the established news media. Even though these sites have many users, legacy media in Finland still occupy a position of trust, reflected in the high score (first) for overall trust in news (62%).

Changing Media

Readership of print newspapers and magazines (47%) continues to decline but from a much higher level than other European countries. Smartphone usage for news (56%) is reaching saturation but remains above the EU average.

Trust

Finnish mainstream news media is not politically divided and the journalists have a relatively strong professional culture that values objectivity and independence. However, according to a recent study by the Finnish Newspaper Association, the trusted image applies better to the traditional news media (printed newspapers, YLE television, and radio) than the online news media.